Landaas & Company newsletter December edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Mike Hoelzl

(with Max Hoelzl, Joel Dresang)

Week in Review (Dec. 18-22, 2023)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

The pace of housing starts picked up in November, especially for single-family units, the Commerce Department reported. The annual rate of new construction rose nearly 15% from October, its fastest pace since May. It was more than 9% ahead of November 2022. Starts for single-family houses rose for the 10th month in a row and was the busiest month since April 2022. Weighed down by a slump in multi-family home construction, authorized building permits declined by 2.5% from their annual rate in October. Single-family permits rose to their highest level since May 2022. Meanwhile, housing under construction continued to hover near the highest level in 53 years of data.

Wednesday

The Conference Board said its consumer confidence index rose in December. The business research group said attitudes toward both current conditions and outlook rose. Expectations of rising interest rates in the next year were the lowest since January 2021. Still, two-thirds of consumers surveyed said they expect a recession in 2024. Rising prices remained their top concern.

Existing home sales rose 0.8% in November for the first increase in six months. The annual rate of 3.8 million houses was 7% behind the pace of the year before, the National Association of Realtors said. The trade group said softening mortgage rates, which dipped below 7% this month for the first time since August, should fuel further sales, but low inventories continued to raise prices. The median sales price of $387,600 was 4% higher than in November 2022, which marked the fifth consecutive year-to-year gain.

Thursday

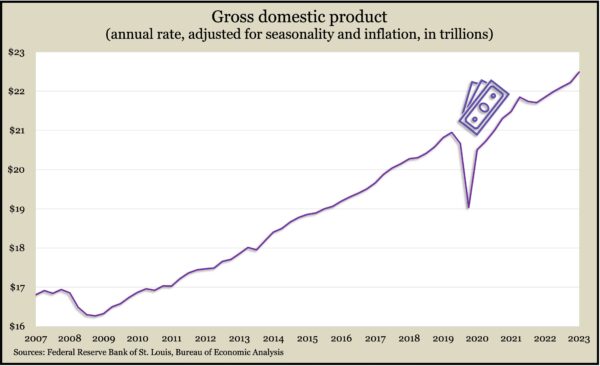

The U.S. gross domestic product grew at an annual pace of 4.9% in the third quarter of 2023, according to a final estimate by the Bureau of Economic Analysis. The economy’s growth rate was down from an initial estimate of 5.2%, as consumer spending wasn’t as brisk. Still the rate was the strongest since the end of 2021. The Federal Reserve’s favorite measure of inflation showed a 2.6% annualized increase, down from an earlier estimate of 2.8%.

The four-week moving average for initial unemployment claims fell for the second week in a row and the fourth time in five weeks. Data from the Labor Department showed the gauge of employers’ willingness to release workers at 43% below the long-term average. Total jobless claims dropped 4% in the latest week to just below 1.8 million, up 17% from the year before.

The Conference Board’s index of leading economic indicators declined 0.5% in November, with stock prices making the only positive contribution for the month. The index dropped 3.5% since May, as opposed to a 4.3% decrease in the previous six months. The business research group said it expected the U.S. economy to enter a “short and shallow” recession in the first half of 2024.

Friday

By far the biggest driver of the U.S. economy, consumer spending, rose 0.2% in November, while inflation continued to slow. The Bureau of Economic Analysis reported that personal income rose 0.4% in November, which meant a slight gain in personal saving. The Fed’s favorite inflation gauge, the personal consumption expenditures index, declined from October, the first drop in that measure since April 2020. The PCE index rose 2.6% from November 2022 – its narrowest increase since February 2021.

The Commerce Department said orders for durable goods jumped 5.4% in November, reversing a 5.1% fall in October. The indicator for manufacturing demand was up 4.5% from the year before. Commercial aircraft led the monthly gain. Excluding transportation equipment, orders rose 0.5% from October and were up 0.8% from November 2022. Core capital goods orders, a proxy for business investments, rose 0.8% for the month and 1.7% from the year before.

The Commerce Department said the annual pace of new home sales fell 12.2% in November, though it still was up 1.4% from the year before. The volatile indicator was more than 15% below its pre-COVID pace. The median price sank 6% from November 2022 to $434,700.

The University of Michigan’s consumer sentiment index rose 14% from December as households continued to lower expectations for inflation. The index reading was up 17% from December 2022 and nearly midway back to where it was before the pandemic after reaching record lows in the summer of 2022. The rise in sentiment was broadly based and improved each of the components in the index. The longstanding survey showed consumers’ inflation expectations at the lowest level since March 2021.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 14993, up 179 points or 1.2%

- Standard & Poor’s 500 – 4755, up 35 points or 0.8%

- Dow Jones Industrial – 37386, up 81 points or 0.2%

- 10-year U.S. Treasury Note – 3.90%, down 0.3 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.