Podcast: Play in new window | Download

Landaas & Company newsletter December edition now available.

Advisors on This Week’s Show

Bob Landaas

Kyle Tetting

Art Rothschild

Kendall Bauer

(with Max Hoelzl, engineered by Jason Scuglik)

Week in Review (Dec. 12-16, 2022)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

The broadest measure of inflation continued to ease in November, declining on a year-to-year rate for the fifth month in a row. The Bureau of Labor Statistics said its Consumer Price Index added 0.1% from October and was up 7.1% from November 2021 after a 40-year high of 9.1% in June. Inflation remained near 1982 levels and far above the Federal Reserve Board’s long-range target of 2%. Shelter costs accounted for most of the monthly increase while the price of gasoline got cheaper. Excluding volatile costs for energy and food, the core 12-month inflation rate was 6%, a second monthly decline since hitting a 40-year high of 6.6% in September.

Wednesday

The policy-making committee of the Federal Reserve Board announced a unanimous decision to raise short-term interest rates another half a percentage point. It was the Fed’s seventh hike this year in its attempt to lower economic demand and ease inflation. The half-point increase was down from recent moves of three-quarters, but the Federal Open Market Committee said it expects more raises ahead.

Thursday

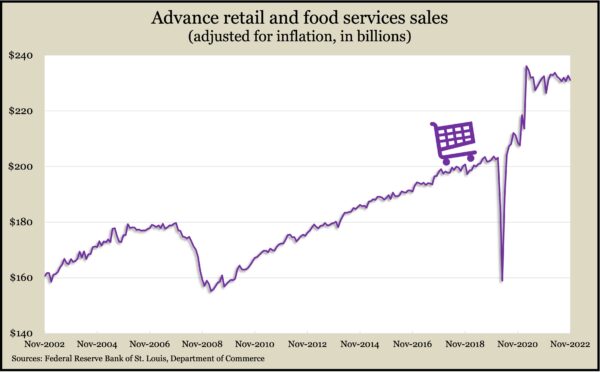

The Commerce Department reported a 0.6% decline in retail sales in November, following a 1.3% gain in October. The drop was broadly distributed: Nine of 13 major categories had lower sales in November, including car dealerships, furniture stores, appliance centers and home-and-garden centers. Consumer spending rose notably at grocery stores and bars and restaurants. Compared to November 2021, only two retail categories had lower sales: Furniture stores and appliance centers. Adjusted for inflation, retail sales fell 0.7% in November, the fifth decline in seven months.

The four-week moving average for initial unemployment claims fell for the first time in six weeks but still close to 40% below its 55-year average. Although data can be marginally affected by seasonal downtime, including around Thanksgiving, the Labor Department reported total claims rising 24% from the week before to nearly 1.6 million. That’s down from almost 2.5 million the year before, suggesting employers’ reluctance to let workers go.

U.S. industrial output fell 0.1% in November, its second drop in a row and the third in four months. The Federal Reserve reported a broad decline in industrial production, led by manufacturing — particularly automakers. Factory output had advanced in the four previous months. Overall industrial production was up 2.5% from the year before. Reflecting the monthly drop in production, the capacity utilization rate fell for the second month in a row, reaching its lowest level since June but still up slightly from its long-term average. The capacity utilization rate is an indicator of inflationary pressure.

Friday

No major announcements

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 10705, down 299 points or 2.7%

- Standard & Poor’s 500 – 3852, down 82 points or 2.1%

- Dow Jones Industrial – 32920, down 556 points or 1.7%

- 10-year U.S. Treasury Note – 3.48%, down 0.09 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail