Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 1-5, 2024)

Significant Economic Indicators & Reports

Monday

U.S. factories began emerging from a slump in March, according to the Institute for Supply Management. The trade group said its manufacturing index suggested the sector expanded for the first time since September 2022 with increased demand and stronger output. The ISM said the turnaround was in an early stage and uneven, with 30% of the firms surveyed still contracting, vs. 40% in February. Based on past trends, the ISM said, the index suggested the gross domestic product was growing at a 2.2% annual rate.

The Commerce Department said construction spending declined by 0.3% in February, the second monthly setback after one year of increases. The seasonally adjusted annual rate of spending neared $2.1 trillion. Residential construction spending, which makes up about 44% of the total, rose 0.7% from January despite a drop in multi-family housing. Government spending, which accounts for 23% of the total, declined 1.2%. Since February 2023, total expenditures rose 10.7% with residential up 6.5% and manufacturing up 32%.

Tuesday

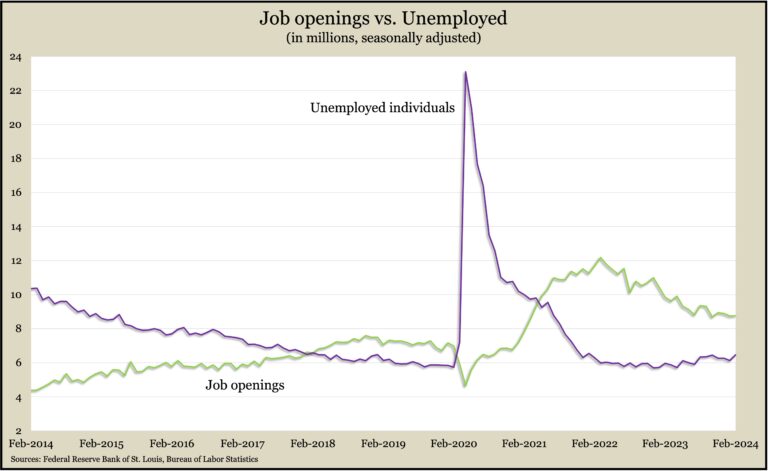

Employers posted marginally more job openings in February, continuing to reflect a labor market in which demand outpaces supply. Postings were just under 8.8 million, down from a record 12.2 million nearly two years ago and still above the 7 million level just before the COVID pandemic. Other signs of a stronger employment market: hirings, separations – including layoffs, firings and voluntary quits – changed little from January.

The Commerce Department reported a 1.4% gain in manufacturing orders in February, the first advance in three months. Demand for commercial aircraft led the increase. Excluding the volatile transportation category, factory orders rose 1.1% from January. Compared to February 2023, total orders were up 1% and up 1.4% excluding transportation. Core capital goods orders, a proxy for business investments, rose 0.7% for the month and were up 1.4% from the year before.

Wednesday

The U.S. services sector expanded in March, though at a slower rate, according to the Institute for Supply Management. The trade group’s services index indicated the 15th month in a row of growth. Based on surveys with purchasing managers, the index showed orders for services cooling while hiring contracted. Logistics and supply chains continued to improve following disruptions in the aftermath of the pandemic.

Thursday

The U.S. trade deficit grew in February for the third month in a row and to its widest gap in 10 months. The Bureau of Economic Analysis said the deficit expanded by 1.9% from January to $68.9 billion. The value of exports rose by 2.3%, led by crude oil, aircraft, soybeans and autos. Imports increased by 2.2%, led by cell phones, travel services, pharmaceuticals and autos. Since February 2023, the gap widened by 2.8% with exports growing 1.8% and imports rising 0.8%. The trade deficit detracts from economic growth, as measured by gross domestic product.

The Labor Department reported that the four-week moving average for initial unemployment claims rose for the third time in four weeks. Average claims remained 42% below the 57-year average, continuing to reflect employer reluctance to let workers go in an historically tight labor market. Total claims were little changed from the week before at 2 million, which was 7% higher than at the same time last year.

Friday

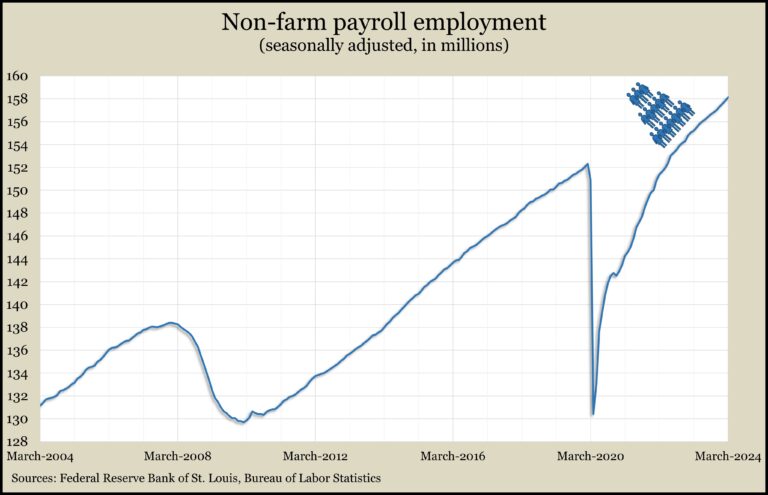

U.S. employers continued to add jobs in March – for the 39th month in a row and at a swifter pace. The jobs report from the Bureau of Labor Statistics showed 303,000 more jobs than February, up from the six-month average of 231,000. The leisure and hospitality industry finally recovered to its February 2020 pre-pandemic employment level. And average hourly wages rose 4.1% from the year before, the smallest gain since June 2021, down from a recent peak of 5.9% two years ago. The unemployment rate was 3.8%, within the narrow range of rates since August. Unemployment has been 4% or lower since the end of 2021, the longest streak since 1965 to 1970.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16249, down 131 points or 0.8%

- Standard & Poor’s 500 – 5204, down 50 points or 1.0%

- Dow Jones Industrial – 38904, down 903 points or 2.3%

- 10-year U.S. Treasury Note – 4.38%, up 0.17 point