Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 15-19, 2024)

Significant Economic Indicators & Reports

No major announcements

Monday

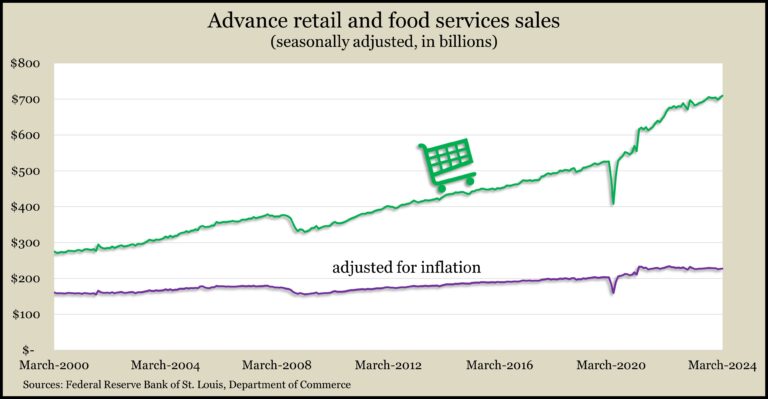

In a further sign of economic resilience, consumers continued spending at stores in March with retail sales advancing 0.7% from February. The Commerce Department reported that 8 of 13 major categories had sales increases in March, including a 2.7% gain for online retailers and a 2.1% rise for gas stations, where sales increased in part because of higher prices. Sales at car dealers declined 1.1%. Furniture stores, appliance centers and sporting goods retailers also suffered setbacks. Sales at bars and restaurants increased by 0.4%, suggesting consumers remain comfortable spending. Adjusted for inflation, retail sales rose 0.3%, a second consecutive gain.

Tuesday

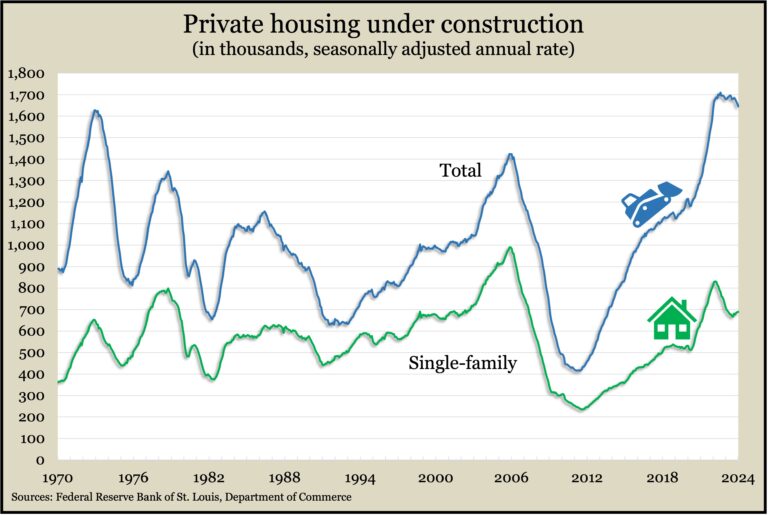

The U.S. housing market continued to suggest weakness in March as the pace for both housing starts and building permits stayed below pre-pandemic levels. Figures from the Commerce Department showed new construction about 25% below its pace in mid-2022. The pace of housing permits, an indicator of commitments to future homebuilding, also continued to hover lower following interest rate boosts by the Federal Reserve two years ago. But both permits and starts remained at levels on par with 2007, before the Great Recession. Meantime, data showed that the rate of houses under construction stayed near record highs, with completions around their fastest pace in 17 years.

Increased automotive manufacturing in March helped boost U.S. industrial production by 0.4% in March. The Federal Reserve reported that industrial output rose at the same pace as in February and was unchanged from the year before. Through the first quarter of 2024, industrial production declined at a 1.8% annual rate led by a 12% drop in mining output. The same report showed the capacity utilization rate, a measure of potential inflation pressure, rising for the second month in a row, though it stayed below the long-time average.

Wednesday

No major announcements

Thursday

The four-week moving average for initial unemployment claims was unchanged for the second week in a row, staying 41% under the long-term average, dating to 1967. The measure of employers’ reluctance to let workers go continued to indicate a tight labor market. According to Labor Department data, total jobless claims fell to 1.9 million in the latest week, down less than 1% from the week before, though up nearly 7% from the year before.

The annual pace of existing home sales sank 4.3% in March, its first setback in four months, dropping 3.7% behind its year-ago rate. The National Association of Realtors said sales have been stagnating because of high interest rates and ongoing low supplies of inventory. The trade group said the median sales price rose 4.8% from the March 2023 to $393,500, the ninth consecutive increase.

The Conference Board reported that its index of leading economic indicators declined 0.3% in March, after a slight gain in February. The business research group said the six-month movement of its index contracted at a slower pace. It suggested the U.S. economic outlook was “fragile – even if not recessionary.” Among the challenges ahead, according to the group, are rising consumer debt, higher interest rates and stubbornly elevated inflation rates.

Friday

No major announcements

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 15282, down 893 points or 5.5%

- Standard & Poor’s 500 – 4967, down 156 points or 3.0%

- Dow Jones Industrial – 37986, up 3 points or 0.0%

- 10-year U.S. Treasury Note – 4.62%, up 0.12 point