By Kyle Tetting

Every new year begins with a host of questions. For 2024, those questions center around some common themes.

Notably:

- Are we in for the economic “soft landing?”

- What is going to happen to stocks after a strong 2023?

- What happens to the magnificent seven stocks?

- What stocks are going to lead next?

- What’s the next shoe to drop?

All reasonable questions and worth pondering. But, as I’ve written before, a calendar year isn’t the most relevant measuring stick with which to answer such questions.

Simply put, investing isn’t a series of one-year decisions. At least the way we approach it, investing is a long-term view of risk and reward. We weigh the opportunity and try to set a course that maximizes the potential while minimizing the volatility.

To that end, a one-year forecast isn’t helpful if it misses key pieces that fall outside the time frame. When a small number of days drive the bulk of a year’s return, for example, having those days fall in December instead of January drastically shifts the thinking on that next year.

With that in mind, my annual looks ahead tend to focus less on where we’ll be in 12 months and more on the current conditions and what they mean for investing more broadly.

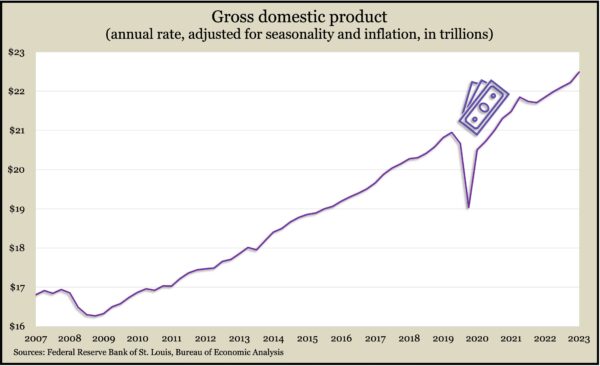

To start, the economy remains on fairly solid footing. We can slice and dice the data and tell any story we want, but if we look at consistent measures across time, there is less opportunity for spin. With an unemployment rate at 3.7% and the ranks of the employed growing steadily, there are more people gainfully working. Bolstered by consumer spending which accounts for more than two-thirds of the economy, U.S. gross domestic product – the output of our economy – has never been higher.

Sure, there are plenty of signs of slowing economic growth and plenty of things to worry over, but none seems more challenging than simply managing expectations. On the heels of a strong 2023, even a modest start to 2024 would leave investors wanting. That’s another danger in simply measuring by a calendar year.

Beyond comparisons to 2023, 2024 has some big shoes to fill. The Federal Reserve’s gradual acceptance of market expectations for rate cuts now seems complete, though we continue to await the Fed’s action. The early days of rising interest rates brought pain to bond investors who are now being rewarded for their patience in the former of higher potential returns on bonds and cash. This isn’t a nod limited to 2024, but there’s a broader anticipation that bonds have more to offer.

As expectations for Fed action evolve, they will have an impact on how we value a stock market that got more expensive – in the form of higher price-to-earnings multiples – toward the end of 2023. Higher multiples aren’t an immediate problem, but they become harder to digest if lower interest rates or higher earnings don’t support the price.

On the earnings front, forecasts call for S&P 500 earnings growth between 9% and 11% in 2024. But because so much can happen in a calendar year, I remain more focused on longer term expectations for what drives earnings and less on where 2024 finishes.

To that end, 2023 was instructive. Much of the year centered around the idea that artificial intelligence would drive productivity growth, and with it, the economy. While some prognostications appear to be early, I am optimistic that we are in the early days of another technological revolution. Modestly expensive stocks suddenly look more affordable in an environment in which increases in efficiency and productivity afford earnings growth that can far outpace sales.

All this is to say that my crystal ball is clouded for 2024 even as the broader outlook shows mostly sunny skies. Our thoughts on what happens in 2024 matter, but the changing calendar does not change the story for me.

The trick, as it was in 2023, will be to find an appropriate balance, allowing us to stay the course and move beyond the short-term volatility that another year of uncertainty will bring.

Kyle Tetting is president of Landaas & Company.

(initially posted Jan. 5, 2024)