From Kendall Bauer

Dear Investor,

Time. It’s the most powerful concept in investing — and yet, it’s often overlooked in favor of louder, flashier terms like crashes, returns, risk and fees. But quietly, time does something none of those can — it gives your potential room to grow.

In one of my favorite films, “Interstellar,” Cooper says, “Time is relative, okay? It can stretch and it can squeeze, but… it can’t run backwards.”

That’s the key. In investing, just like in physics, once time moves forward, you can’t rewind it. The earlier you begin, the more of this irreplaceable force you give your money to compound. Wait too long, and your greatest advantage starts slipping away.

That word — compound— is really the heart of it. Compounding is what happens when your investment earns money, and then that money begins to earn money too. Think of it like a snowball rolling downhill. It starts small, but the longer it rolls, the more it picks up — and the faster it grows. The magic isn’t just in howmuch you invest, but in how long you give that snowball time to roll.

The most powerful asset a young investor holds isn’t a six-figure salary or access to inside information. It’s time.

Let’s take a quick example.

Learn more

The power of compounding in investments, a Money Talk Video with Dave Sandstrom

What is compound interest? from Investor.gov

Compound Interest Calculator, from Investor.gov

FINRA’s Savvy Investor on What is Compound Interest? a YouTube video

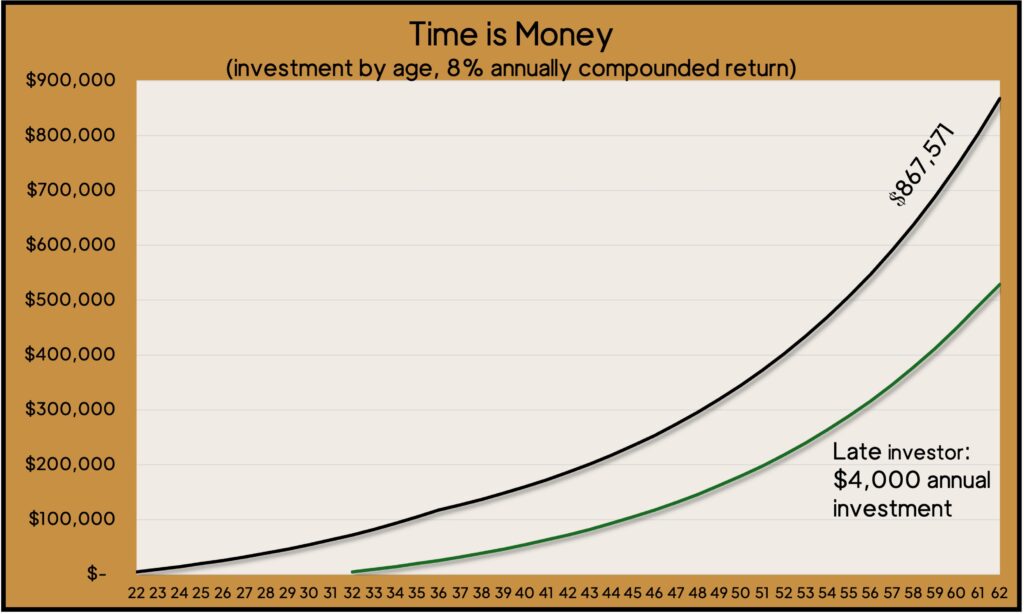

If you start investing in your early 20s, say by contributing $4,000 per year from age 22 to 36 — just 15 years — you’ll have put in a total of $60,000. Then you stop. No more contributions.

Now, someone else waits and starts investing at age 32. They also contribute $4,000 annually, for the next 30 years contributing a total of $120,000.

Assuming an 8% average annual return, the early investor ends up with $867,571 at age 62. The later investor? Despite investing nearly three times more, they end up with $528,534.

That’s a difference of $339,037 — simply for starting early.

This isn’t meant to discourage anyone who’s starting later in life. We’ll talk about late starts in future letters. But today’s takeaway is simple: Early action gives you a powerful edge.

You can begin investing with just $25 or $50 a month — sometimes even less. Skip a couple of coffees a week, and suddenly you’ve got the start of something real. What matters most is building the habit and letting time work on your behalf.

Start early. Start small. Be consistent. Invest even a little at a time and let your portfolio grow, undisturbed. That’s how you build wealth.

Until next time,

Kendall

Kendall Bauer is vice president and investment advisor at Landaas & Company, LLC.