Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 19-23, 2026)

Significant Economic Indicators & Reports

Monday

Markets and government offices closed for Martin Luther King Jr. Day

Tuesday

No major releases

Wednesday

U.S. construction spending rose in October for the fourth time in five months. Data from the Commerce Department, delayed by the government shutdown in the fall, showed the seasonally adjusted annual rate of building expenditures up 0.5% from September. It was 1% below its year-ago pace. Spending on residential construction — accounting for 57% of the total — slipped 1.2% from the October 2024 pace. Manufacturing accounted for 10% of all construction spending and was down 11% from a record high last May.

An early indicator of home sales declined in December. The National Association of Realtors’ index of pending home sales dropped 9.3% from November and was down 3% from December 2024. The trade group said several seasonal factors could have affected the reading but that low inventories probably dampened demand. At 71.8, the index of pending sales was nearly 30% below what the association considers normal. Total sales for 2025 tied with the year before for the lowest since 1995.

Thursday

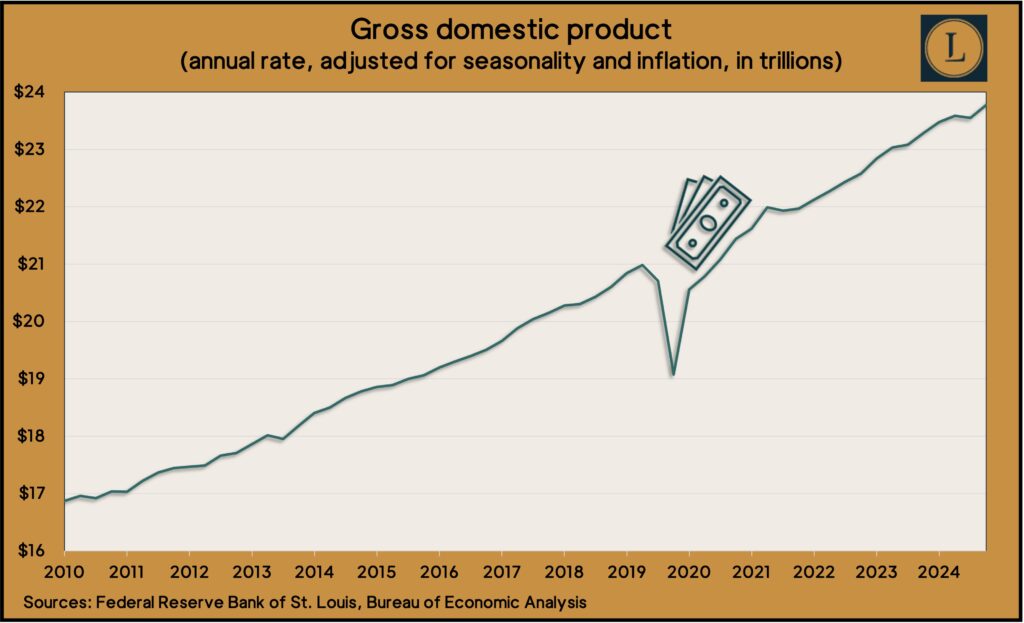

The U.S. economy grew at an annual pace of 4.4% in the third quarter, up from 3.8% in the previous three months and the highest rate in two years. The Bureau of Economic Analysis said the acceleration in gross domestic product was led by consumer spending, exports, government spending and investments. A decline in imports also contributed to the third-quarter gain.

The 4.4% pace was revised from 4.3% in an earlier estimate. Since the third quarter of 2024 and adjusting for inflation, GDP rose 2.3%.

The four-week moving average for initial unemployment claims fell for the third week in a row and the fourth time in five weeks to reach the lowest level in two years. The average was 44% below the all-time average dating back to 1967. The Labor Department said 2.3 million Americans claimed jobless benefits in the latest week, up more than 5% from the week before and 1.5% higher than the same time in 2025.

The Bureau of Economic Analysis said consumer spending rose 0.5% in November, outpacing a 0.3% increase in personal income. As a result, the personal saving rate dipped to 3.5% of disposable income, the lowest in more than three years. The personal consumption expenditures index, the Federal Reserve Board’s favorite measure of inflation, rose 2.8% from November 2024, up from 2.7% in October. The inflation rate remained above the Fed’s 2% long-term target but was below a four-decade high exceeding 7% in June 2022.

Friday

The University of Michigan said its consumer sentiment index improved from December with a small, broadly based increase. The index rose 6.6% from the month before and remained 21% below where it stood in January 2025, as consumers continued to complain about high prices and expressed concerns about weakening job conditions. Expectations for inflation ran at 4% in the next year and 3.3% longer term. Consumers’ outlook for inflation stayed high historically but was down from mid-2025 peaks, which were blown up by worries over global trade wars.

The U.S. economy should slow in 2026, the Conference Board said, based on its November report of leading economic indicators. The business research group said its index declined 0.3% in November after dropping 0.1% in October, led by weak consumer expectations and falling demand for manufactured goods. Among the positive indicators were fewer unemployment insurance claims and more factory hours worked. For the latest six months, the index fell 1.2%, compared to a decline of 2.6% in the previous six months.

Market Closings for the Week

- Nasdaq – 23501, down 14 points or 0.1%

- Standard & Poor’s 500 – 6916, down 24 points or 0.4%

- Dow Jones Industrial – 49099, down 261 points or 0.5%

- 10-year U.S. Treasury Note – 4.24%, up 0.01 point