Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Jason Scuglik, Joel Dresang )

Week in Review (Sept. 29-Oct. 3, 2025)

Significant Economic Indicators & Reports

Monday

Demand for housing rose in August, according to the pending home sales index from the National Association of Realtors. The index, based on the number of houses sold in 2001, increased to 74.7, up 4% from July and 3.8% ahead of where it stood in August 2024. The trade group said lower mortgage rates were encouraging more home shoppers, especially in the Midwest, where improved affordability also factored in. Pending sales in the Midwest rose 8.7% from July, the Realtors reported, and were up 6.7% from the year before.

Tuesday

Housing prices slowed again in July, staying below the overall inflation rate for the third month in a row, according to the S&P Cotality Case-Shiller home price index. Compared to the year before, the national index rose 1.7%, one of the narrowest increases in a decade, compared to a 2.7% increase in inflation in July, as measured by the Consumer Price Index. An analyst with the index said higher mortgage rates and stretched affordability have weakened demand for housing. He said housing prices have cooled from the hot market following the COVID-19 pandemic and should track closer to overall inflation, or below.

The Conference Board said its consumer confidence index fell in September to its lowest level since April. Consumers particularly downgraded their assessments of current conditions, with their confidence in the job market decreasing for the ninth straight month. Low expectations remained at recessionary levels for the eighth month in a row. The business research group said inflation edged out tariffs as consumers’ top concern.

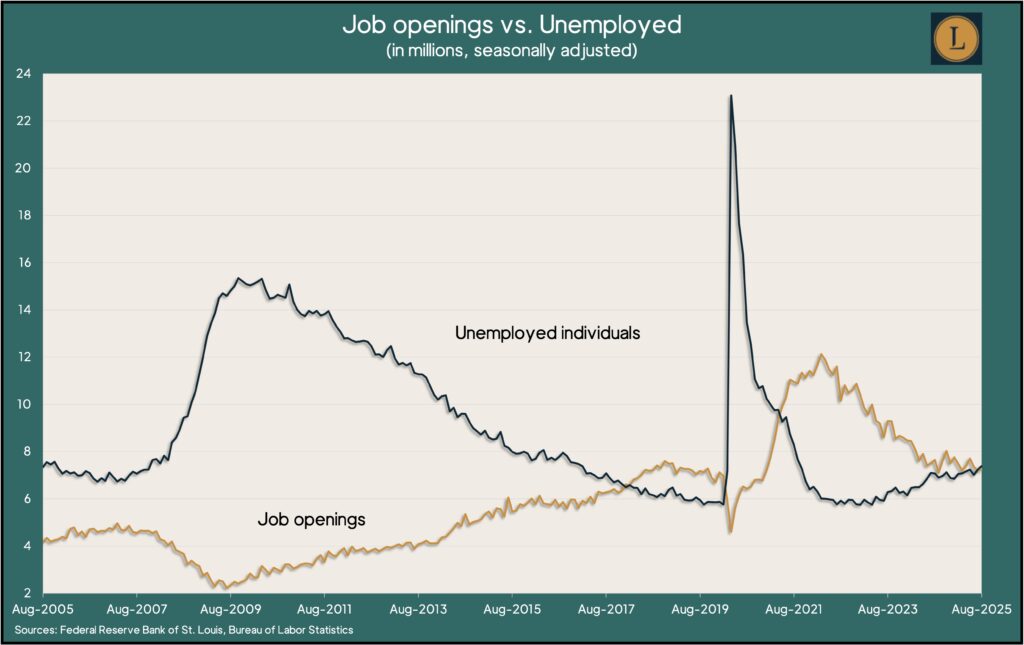

Unemployed job seekers outnumbered job openings in August for the first time in more than four years. A new report from the Bureau of Labor Statistics showed demand for workers continuing to erode compared to supply. Employers posted nearly 7.2 million openings in August, up 3% from July but down 5.5% from the year before. Demand for employees reached an all-time high of 12 million openings in March 2022 but remains above the pre-pandemic level of 7 million. The rate of employees quitting their jobs – a sign of worker confidence – was below the February 2020 level for the 22nd month in a row.

Wednesday

Manufacturing continued its slump in September, according to the Institute for Supply Management’s manufacturing index. The index signaled contraction for the seventh month in a row and the 33rd time in 35 months. The production component of the index showed expansion. The employment component indicated contraction for the eighth month in a row. Purchasing managers surveyed by the trade group frequently cited tariffs among their challenges. The ISM said the index reading suggested the U.S. economy is growing at an annual pace of 1.9%.

ADP said its national employment report showed private employers had a net loss of 32,000 jobs in September. The payroll services company said many of the jobs lost were in leisure and hospitality, professional and business services and financial activities. Compared to September 2024, private employment was up 4.5%. ADP reported that wages also rose 4.5% from the year before. An economist for ADP said the report validated other signs that employers are being cautious about hiring.

A scheduled release of construction spending was delayed because of the federal government shutdown.

Thursday

Scheduled reports on unemployment insurance claims and manufacturing orders were not released because of the federal government shutdown.

Friday

Following three months of weak expansion, the U.S. services sector reached a break-even point between expansion and contraction in September. The Institute for Supply Management said its services index hit 50 for the first time since 2010. The key business activity component of the index contracted for the first time since May 2020 while growth in new orders slowed and hiring slumped for the fourth month in a row. The trade group said companies surveyed reported moderate to weak growth overall. Based on the past relationship between the index and gross domestic product, ISM said the economy appeared to be growing at an annual rate of 0.4%.

The September report on U.S. payroll employment and individual employment situations was delayed because of the federal government shutdown.

Market Closings for the Week

- Nasdaq – 22781, up 296 points or 1.3%

- Standard & Poor’s 500 – 6716, up 72 points or 1.1%

- Dow Jones Industrial – 46758, up 511 points or 1.1%

- 10-year U.S. Treasury Note – 4.12%, down 0.07 point