Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, engineered by Jason Scuglik)

Week in Review (Aug. 11-15, 2025)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

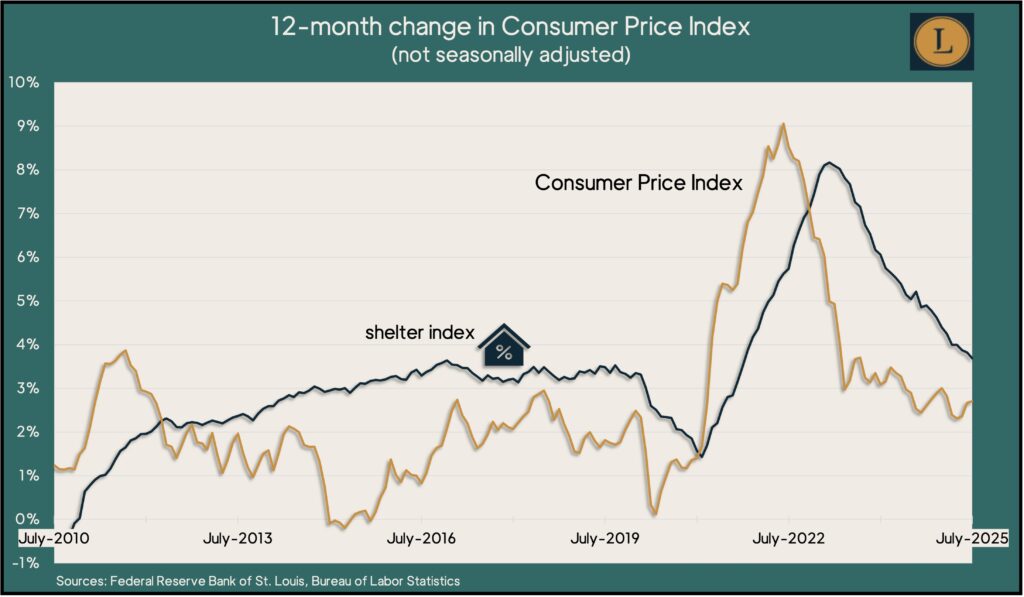

The pace of broad inflation stayed above long-range Federal Reserve targets in July. The Bureau of Labor Statistics said its Consumer Price Index rose 2.7% from July 2027. The rate was unchanged from June and continued to outpace the Fed’s aim of 2%. It was down from a 41-year high of 9.1% in June 2022. Shelter costs were the “primary factor” for the 0.2% increase in the index from June, according to the report, with food prices unchanged overall and the cost of gasoline down 2.2% for the month. Excluding volatile food and energy costs, the core CPI rose at the fastest pace in six months and was at a five-month high, year to year. Some analysts pointed at higher prices for goods such as furniture and consumer electronics as early signs of inflation fueled by higher U.S. tariffs.

Wednesday

No major announcements

Thursday

Inflation on the wholesale level rose 0.9% in July and was up 3.3% from the year before, according to the Producer Price Index. The Bureau of Labor Statistics reported that the price for services increased the most in more than three years. The core PPI, which excludes volatile prices for food, energy and trade services, also rose the most since March 2022.

The four-week moving average for initial unemployment claims rose for the first time in eight weeks. An indication of employers’ willingness to let go of workers, the rolling average was 39% below the long-term average dating back to 1967. Total jobless claims dropped 0.2% from the week before to just over 2 million, which was up 5.2% from the same time in 2024.

Friday

The Commerce Department reported on retail sales for July. Economists watch the retail numbers because they measure about two-thirds of U.S. consumer spending, which accounts for around 70% of U.S. economic activity, as measured by the gross domestic product.

The Federal Reserve reported on industrial production in July, reflecting both the output and capacity of manufacturers, utilities and the mining industry. The report includes updates on how much of their capacities industries are using. High capacity utilization rates can portend higher inflation as industries raise prices to expand.

The University of Michigan reported on its consumer sentiment index. The preliminary August reading of the survey-based index shows how U.S. consumers are feeling toward current economic conditions and their personal financial situations. It also indicates expectations for future conditions, including inflation. Economists monitor sentiment as a predictor of consumer spending.

Market Closings for the Week

- Nasdaq – 21623, up 173 points or 0.8%

- Standard & Poor’s 500 – 6450, up 60 points or 0.9%

- Dow Jones Industrial – 44943, up 771 points or 1.7%

- 10-year U.S. Treasury Note – 4.33%, up 0.04 point