Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Aug. 4-8, 2025)

Significant Economic Indicators & Reports

Monday

A deep drop in demand for commercial aircraft and parts sank factory orders in June. The Commerce Department reported that total orders declined 4.8% from May, the second setback in three months. Compared to the year before, orders were up 3.8%. Excluding volatile orders for transportation equipment, demand for factory goods increased 0.4% for the month and were up 0.6% from the year before. Core capital goods orders, a proxy for business investments, fell 0.8% from May and were up 2% from June 2024.

Tuesday

The U.S. trade deficit narrowed 16% in June to $60.2 billion, the Bureau of Economic Analysis reported. The value of outgoing goods and services decreased 0.5%, led by sales of industrial materials. Imports sank 3.7% from May led by pharmaceuticals and automotive products. Swings in exports and imports have been distorted in recent months as companies and consumers have tried to plan for drastic changes in U.S. tariff rates. Through the first half of 2025, the trade gap expanded 38.3% from the year before with gains of 5.2% in exports and 12.1% in imports. The trade deficit detracts from U.S. economic growth, as measured by gross domestic product.

The non-manufacturing sector stayed in expansion mode again in July, although at a slower pace, according to the ISM Services Index. The survey-based report from the Institute for Supply Management last registered a contraction in May. The trade group cited resilience among service companies with reports of negative impacts from recent seasonal and weather conditions. Survey respondents shared ongoing concerns about the costs of tariffs and said some commodity prices are increasing.

Wednesday

No major releases

Thursday

Worker productivity increased at a solid 2.4% annual rate in the second quarter, the Bureau of Labor Statistics reported. The gain came on 3.7% higher output with workers putting in 1.3% more hours. Year to year, productivity rose 1.3%. Unit labor costs rose at a 1.6% annual rate and were up 2.6% from the year before. In the current business cycle, which began at the end of 2019, productivity has been growing at a 1.8% annual pace, compared to a 1.5% rate during the previous cycle, which started in 2007. The average productivity rate since 1947 is 2.1%.

The four-week moving average for initial unemployment claims fell for the seventh week in a row to the lowest level since April. The indicator of employer willingness to let workers go stayed 39% below the all-time average, according to Labor Department data. The level was 7% above where it was just before the 2020 COVID pandemic. The total number of claims stayed just over 2 million, which was up 3.8% from the same time last year.

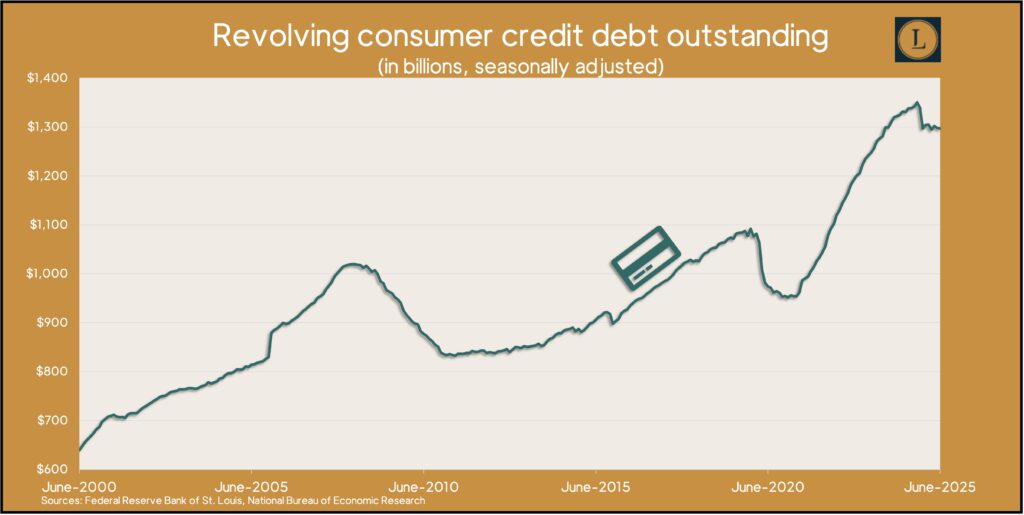

In a sign of weakening consumer confidence, credit card debt receded in June for the third time in four months. The Federal Reserve reported a 1% decline in the annual rate of revolving consumer debt outstanding, following a 3.5% setback in May. The pace of total consumer debt rose at a 1.8% pace from May, including a 2.7% increase in non-revolving debt – mostly car financing and student loans. With about 70% of U.S. economic growth relying on consumer spending, the drop in credit card debt suggests a drop-off in commitment to buying. Credit card debt grew at a 2.3% rate in the second quarter but was down 3.9% from its peak last October.

Friday

No major releases

Market Closings for the Week

- Nasdaq – 21450, up 800 points or 3.9%

- Standard & Poor’s 500 – 6389, up 151 points or 2.4%

- Dow Jones Industrial – 44176, up 587 points or 1.3%

- 10-year U.S. Treasury Note – 4.29%, up 0.06 point