Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, engineered by Jason Scuglik)

Week in Review (July 14-18, 2025)

Significant economic indicators & reports

Monday

No major releases

Tuesday

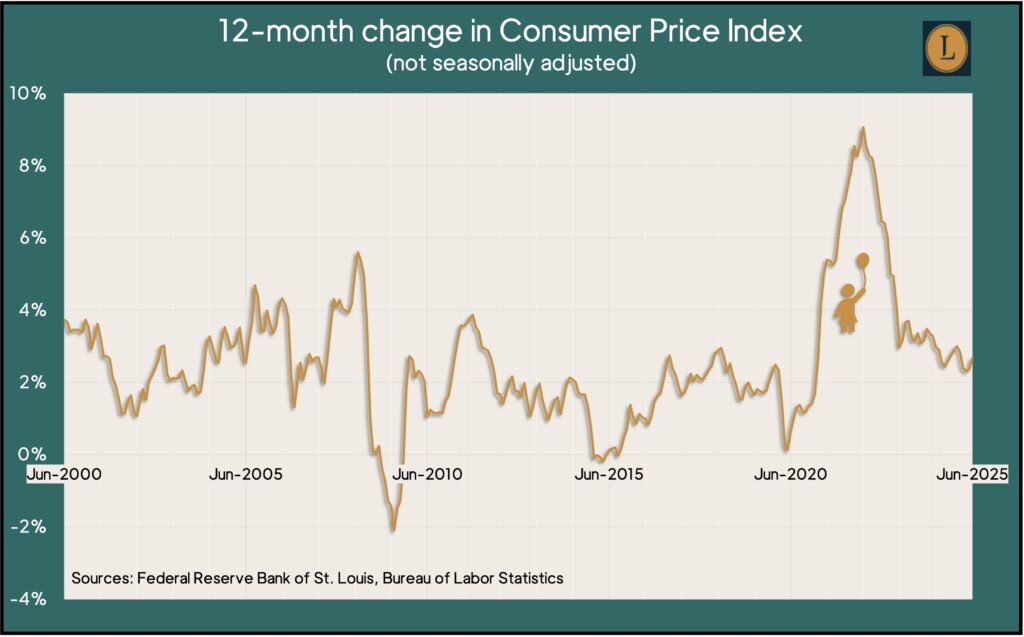

The broadest measure of inflation rose at a 2.7% annual rate in June, up the second month in a row after hitting a four-year low in April. But the rate also was less than one-third of where it peaked three years ago. The Bureau of Labor Statistics reported that the Consumer Price Index rose 0.3% from May, largely because of increased costs for shelter. Other notable price gains included household furnishings, appliances, toys and apparel, which some analysts suggested might be showing signs of increased tariffs. Gasoline prices rose in June for the first time in five months. The 2.7% year-to-year increase stayed above the 2% long-term target of the Federal Reserve. Excluding volatile energy and food costs, the core index rose 0.2% from May and was up 2.9% from the same time last year.

Wednesday

Wholesale inflation was subdued in June. The Producer Price Index was unchanged from May and up 2.3% from the year before, the slowest gain since September. The Bureau of Labor Statistics reported that higher prices for goods offset a slight decrease in service costs in June. Excluding volatile costs for food, energy and trade services, inflation on the wholesale level also was unchanged from May and 2.5% higher than June 2024, which was the lowest one-year rate since November 2023.

The Federal Reserve said industrial production rose in June for the first time in four months. Output from manufacturing, mining and utilities grew 0.3% from May and was up 0.7% from June 2024. The annual pace of industrial production for the second quarter was 1.1%. Meantime, industrial capacity usage – which can indicate future inflation pressure – rose for the first time since February to 77.6%, below its 50-year average for the 44th consecutive month.

Thursday

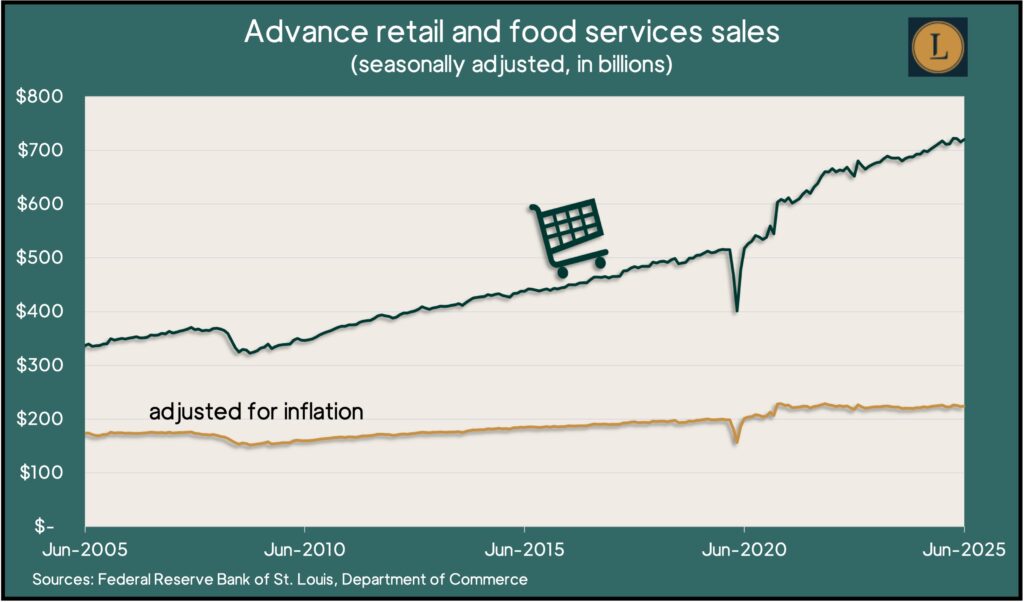

A key measure of consumer spending rebounded in June after two months of decline. The Commerce Department reported retail sales rose 0.6% from May. Of 13 categories of retailers, 10 had higher sales, led by car dealers, home-and-garden centers, clothing stores and restaurants and bars. Increased sales can reflect increased volume but also higher prices, which some analysts expect in goods and services affected by higher tariffs. Adjusted for inflation, retail sales rose 0.3% in June.

The four-week moving average for initial unemployment claims fell for the fourth week in a row, the Labor Department reported. The measure of employers’ plans to let workers go was 37% below the all-time average dating back to 1967. It was up 11% from its mark just before the pandemic. In the latest week, total claims dropped 0.2% to 1.9 million, which was up nearly 6% from the same time last year.

Friday

The U.S. housing market picked up in June, based on the annual pace for housing starts and building permits. The Commerce Department reported that new construction rose 4.6% from May, which was the weakest month since the COVID-19 pandemic. Housing starts were on par with their pace in late 2006 and below the pre-pandemic level for the 15th month in a row. Building permits, signifying future construction, rose 0.2% from May and were level with activity in mid-2007.

Stalled by anticipation of tariff-triggered inflation, consumer sentiment rose marginally from June though it was 16% below where it started the year, according to a preliminary report by the University of Michigan. Seen as a precursor to consumer spending, sentiment remained low historically, the report said, and it likely won’t improve until consumers feel beter about price increases.

Market Closings for the Week

- Nasdaq – 20896, up 310 points or 1.5%

- Standard & Poor’s 500 – 6297, up 37 points or 0.6%

- Dow Jones Industrial – 44342, down 29 points or 0.1%

- 10-year U.S. Treasury Note – 4.43%, up 0.01 point