Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (June 23-27, 2025)

Significant Economic Indicators & Reports

Monday

The National Association of Realtors said existing home sales rose in May while remaining near the slowest in decades. The seasonally adjusted annual rate of 4.03 million houses sold was 0.8% ahead of April’s pace. It was 0.7% lower than the year before and below the 4.06 million houses sold for all of 2024, which was the weakest since 1995. The trade association blamed “persistently high mortgage rates” but noted that inventories are building, up 6% from April and up 20% from May 2024. Increased supply wasn’t enough to lower prices. The median sales price rose to $422,800, up 1.7% from May 2024, the 23rd consecutive increase.

Tuesday

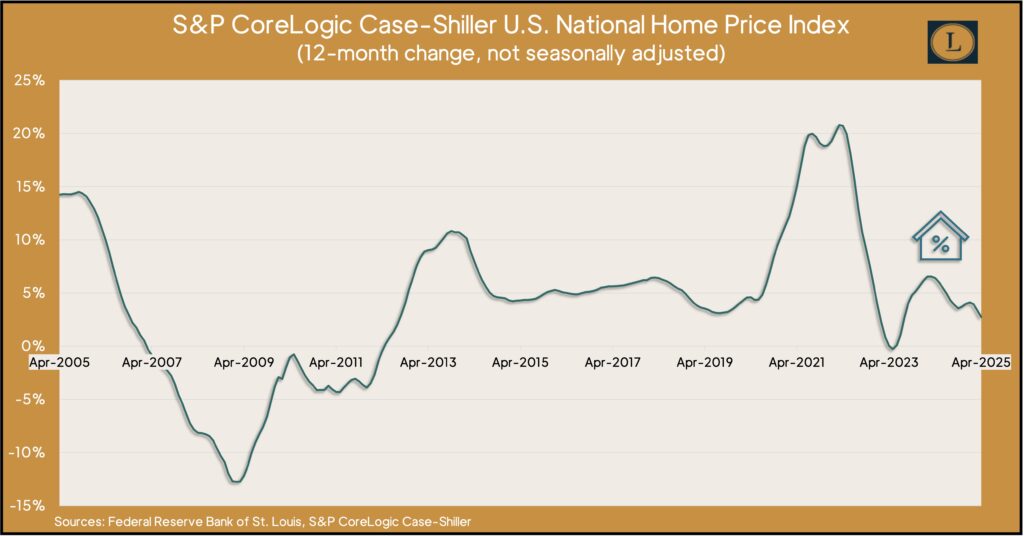

Housing prices increased in April at their slowest pace in nearly two years, according to the S&P CoreLogic Case-Shiller home price index. Continuing a broad deceleration, prices in April rose 2.7% from April 2024, down from a 3.4% year-to-year increase in March and the lowest since August 2023. Seasonally adjusted, the index shrank 0.4% from March. In a statement, S&P said the index suggests ongoing challenges for the housing market, with “severely constrained” supply. It said demand was hampered by monthly payments “near generational highs.” Housing prices have been a sticking point for Federal Reserve efforts to slow down overall inflation.

The Conference Board said its consumer confidence index dropped in June amid ongoing concerns about tariffs. Expectations dipped well below a measure suggesting near-term recession, and attitudes toward job availability stayed positive while declining for the sixth month straight. The business research group reported a broad demise in consumer confidence, led by those survey respondents identifying as Republican. Among the few categories in which consumers reported increased activity was dining out.

Wednesday

The annual rate of new home sales sank nearly 14% in May and was down 6% from the previous year. May marked the fourth time in five months sales fell below the pre-pandemic level. The Commerce Department reported that the inventory of new houses for sale was 8.9 months’ worth, up from 7.6 the year before. The median sales price of a new house rose 3% from May 2024 to $426,200.

Thursday

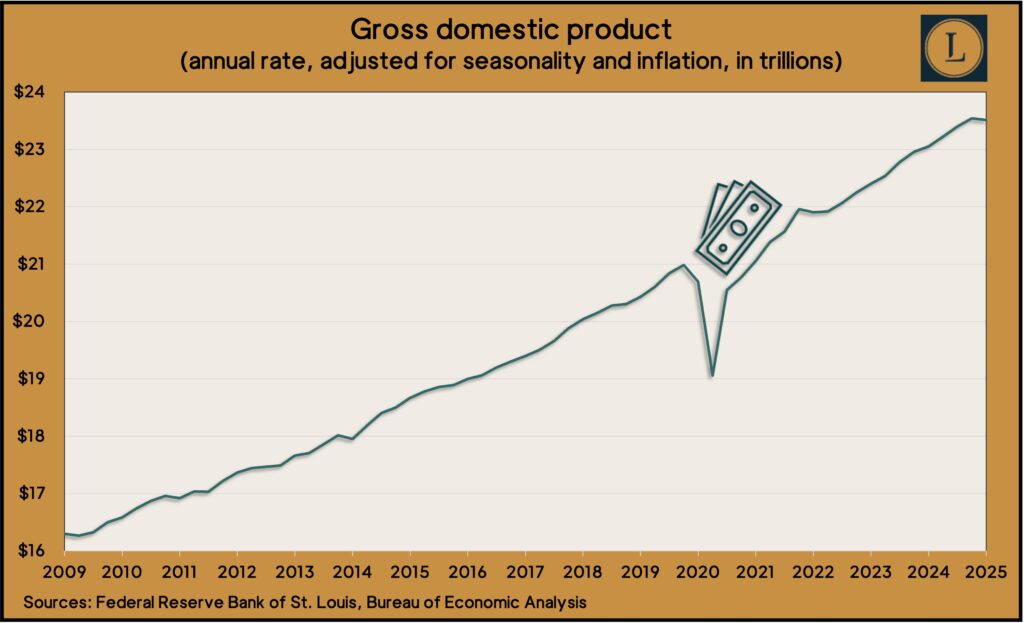

The U.S. economy shrank at an annual pace of 0.5% in the first quarter, the first setback in four years, according to the last of three estimates of gross domestic product. The rate was worse than a previous estimate of a 0.2% contraction, mostly because of weaker consumer spending, which drives more than two-thirds of the economy. Initially reported at 1.2%, consumer spending rose at an annual rate of 0.5%, the lowest since the onset of the COVID-19 recession. Consumer spending slowed after surging at the end of 2024, a buying spree attributed to the anticipation of higher prices from increased tariffs. Similarly, imports – which weigh against economic growth – rose at record levels in the first quarter, contributing to the economy’s slowdown.

The four-week moving average for initial unemployment claims fell slightly for the first time in four weeks, staying near a two-year high. Labor Department figures show the moving average was 32% below the 58-year average. More than 1.8 million Americans were claiming unemployment compensation in the latest week, down less than 1% from the week before and up 5% from the year before.

Orders for durable goods rose 16.4% in May, boosted by large orders of commercial aircraft. The measure of manufacturing demand was up 6.9% from May 2024. Excluding volatile orders for transportation equipment, orders increased 0.5% from April and were up 1% from the year before. Core capital goods orders, which indicate business investments, rose 1.7% for the month and were 1.5% higher than the year before.

Pending home sales advanced 1.8% in May but continued to reflect a weak housing market, according to an index from the National Association of Realtors. Demand for existing houses was more than 1% above where it was the year before but about 28% below the index base set by the trade group in 2001. The association cited steady jobs and rising wages as positive factor for real estate sales but cited mortgage rates as a deterrent.

Friday

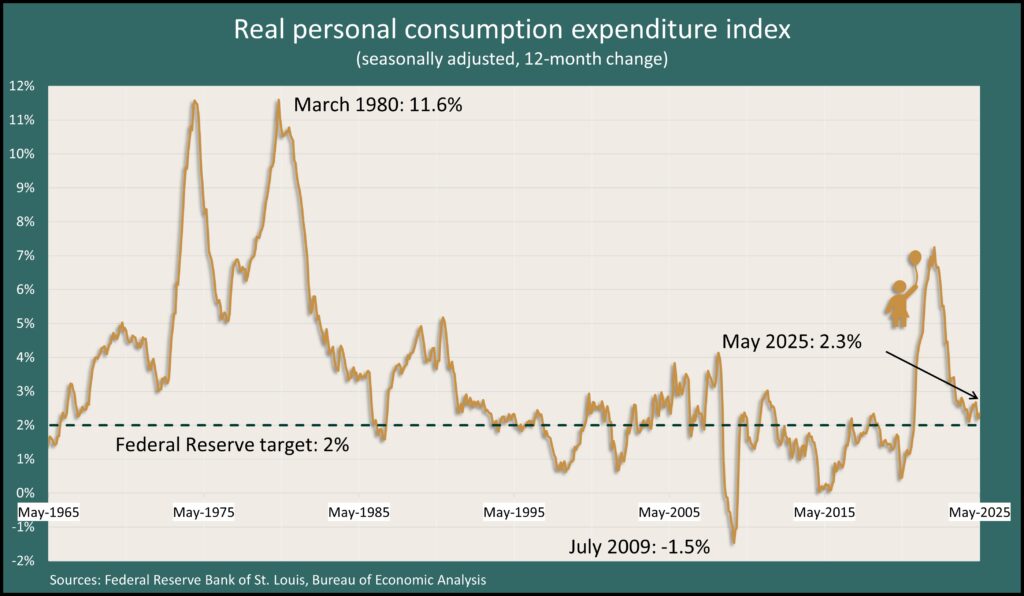

Inflation stayed subdued in May amid lower consumer spending, according to the Bureau of Economic Analysis. The Federal Reserve Board’s favorite measure of inflation rose to 2.3% from the year before, down from a four-decade high of 7.2% three years ago, but still above the Fed’s long-range target of 2%. The personal consumption expenditures index fell 0.1% from April following increased spending in anticipation of higher prices from tariffs. The personal saving rate fell to 4.5% of disposable income from 4.9% in April, as personal income declined 0.4%.

A precursor to consumer spending, consumer sentiment, rose in June for the first time in six months though it remained mired in expectations of a slower economy and higher inflation. The University of Michigan said its longstanding consumer survey found attitudes 16% more optimistic than in May but 16% lower than a year ago and 18% below a post-election peak in December. Fears of tariffs softened somewhat in June but still fueled beliefs that inflation would be up 5% in the next year. That was down from an expectation of 6.6% inflation in May.

Market Closings for the Week

- Nasdaq – 20273, up 826 points or 4.2%

- Standard & Poor’s 500 – 6173, up 205 points or 3.4%

- Dow Jones Industrial – 43819, up 1612 points or 3.8%

- 10-year U.S. Treasury Note – 4.28%, down 0.09 point