Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (June 2-6, 2025)

Significant Economic Indicators & Reports

Monday

The manufacturing sector shrank again in May. The Institute for Supply Management said its manufacturing index landed under 50 for the third month in a row and the 29th time in 30 months, suggesting the industry was contracting. The trade group reported further slowdowns in measures of demand and output with weakening inputs. ISM surveys showed supply managers citing the uncertainty of “tariff whiplash” and delays and cuts in federal government spending. The ISM said the index suggested the U.S. economy was shrinking at an annual rate of 1.7%.

The pace of construction spending fell 0.4% in April, the second consecutive setback. The annual rate of $2.1 trillion was down 0.5% from April 2024, the Commerce Department reported. Residential spending, which accounted for about 42% of the total, dropped 0.9% from the March pace and was down almost 5% from the year before. Nearly every category of private-sector construction spending declined while government spending expanded, led by streets and highways.

Tuesday

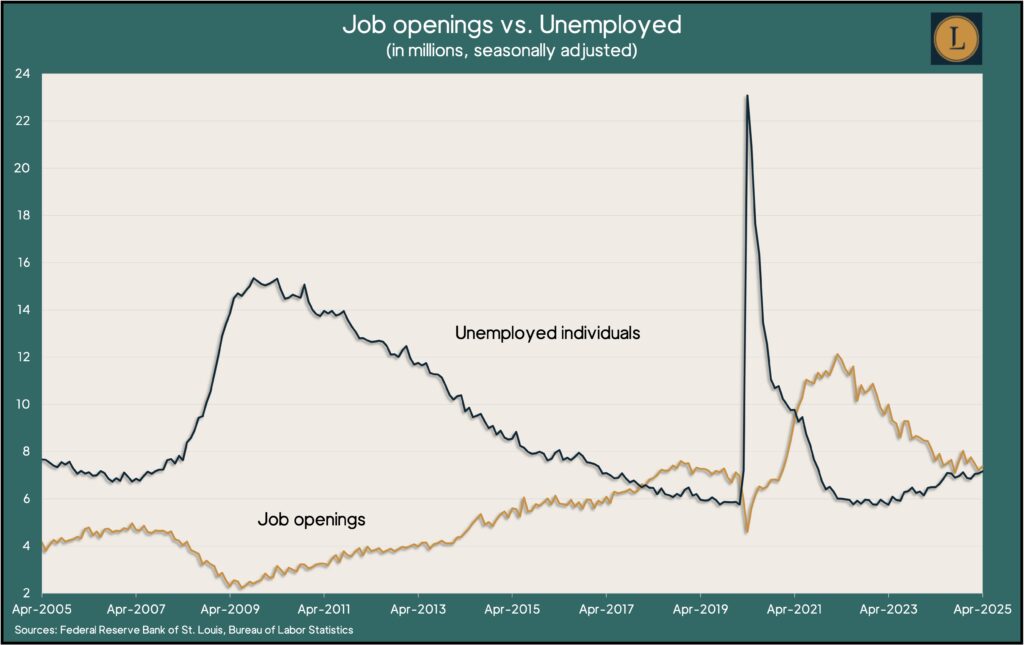

U.S. employers posted nearly 7.4 million job openings in April, up slightly from March and still above the pre-pandemic level. Want ads continued to outnumber unemployed job seekers, but by a relatively narrow gap, especially since openings peaked at 12.1 million in mid-2022. The Bureau of Labor Statistics reported that overall levels of hiring and separations stayed about the same since March. The degree to which workers were quitting their jobs voluntarily – a sign of worker confidence in the hiring market – remained below the pre-pandemic level for the 17th month in a row.

Demand for manufactured goods fell in April for the first time in five months, largely because of a decline in orders for commercial aircraft. The Commerce Department said factory orders shrank 3.7% from March and were up 2% from April 2024. Excluding volatile orders for transportation equipment, sales declined 0.5% for the month and were up 0.4% from the year before. Orders for core capital goods, a proxy for business investments, increased by 0.3% in April and were up 1.3% from the same time last year.

Wednesday

The U.S. services industry contracted in May for the first time in 11 months and only the fourth time in five years, according to the Institute for Supply Management. The ISM services index, based on surveys of purchasing managers, suggested the largest sector of the economy receded slightly because of broad uncertainty over wobbly tariff policies. Correspondents expressed difficulty forecasting and planning. The trade group said based on past relationships between the index and U.S. gross domestic product, the overall economy grew in May at an annual rate of 0.4%.

Thursday

The U.S. trade deficit narrowed 56% to $61.6 billion in April after anticipation of tariffs led to a record trade gap in March. The Bureau of Economic Analysis reported that U.S. exports rose 3% in April, led by industrial supplies and materials. Imports sank 16%, led by pharmaceuticals. Through the first four months of 2025, the trade gap grew 66% from the year before. In that time, exports gained 5.5%, and imports rose 18%. Trade deficits count against gross domestic product, the main measure of the U.S. economy.

The Bureau of Labor Statistics said worker productivity fell at an annual rate of 1.5% in the first quarter. It was the first decline since the second quarter of 2022 and was nearly twice as severe as a preliminary estimate for the latest quarter. Non-farm output dropped at an annual pace of 0.2% in the first three months of the year while hours worked rose at a 1.3% rate. Since the first quarter of 2024, productivity climbed 1.3%. Since just before the pandemic, productivity has increased by an annual rate of 1.8%, compared to a 1.5% pace in the previous business cycle, which began in 2007. Since 1947, productivity has grown at an average annual rate of 2.1%.

The four-week moving average of initial unemployment claims rose for the fifth time in six weeks and continued to suggest a tight hiring market. The measure of employers’ willingness to let workers go was 35% below its average since 1967, according to Labor Department data. Just over 1.8 million Americans claimed jobless benefits in the latest week, down 0.2% from the week before but up almost 7% from the same time last year.

Friday

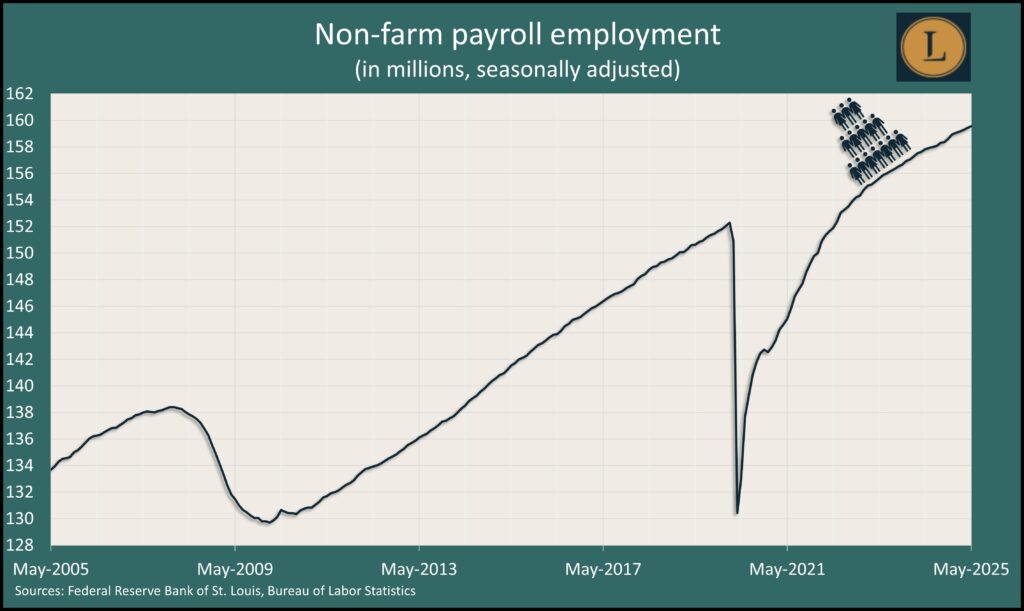

U.S. employers added 139,000 jobs in May, more than analysts expected and near the 12-month average, according to the May jobs report from the Bureau of Labor Statistics. Employers have padded payrolls for 53rd months in a row, showing a steady appetite for workers. The unemployment rate stayed at 4.2% for the third month in a row, remaining in a 4%-4.2% range for the last year. The annual pace in wage increases stayed at 3.9%, staying ahead of overall inflation, as it has for the last two years.

Market Closings for the Week

- Nasdaq – 19530, up 416 points or 2.2%

- Standard & Poor’s 500 – 6000, up 89 points or 1.5%

- Dow Jones Industrial – 42763, up 493 points or 1.2%

- 10-year U.S. Treasury Note – 4.51%, up 0.09 point