Podcast: Play in new window | Download

- Advisors on This Week’s Show

- Kyle Tetting

- Dave Sandstrom

- Kendall Bauer

(with Max Hoelzl and Joel Dresang engineered by Jason Scuglik)

Week in Review (May 12-16, 2025)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

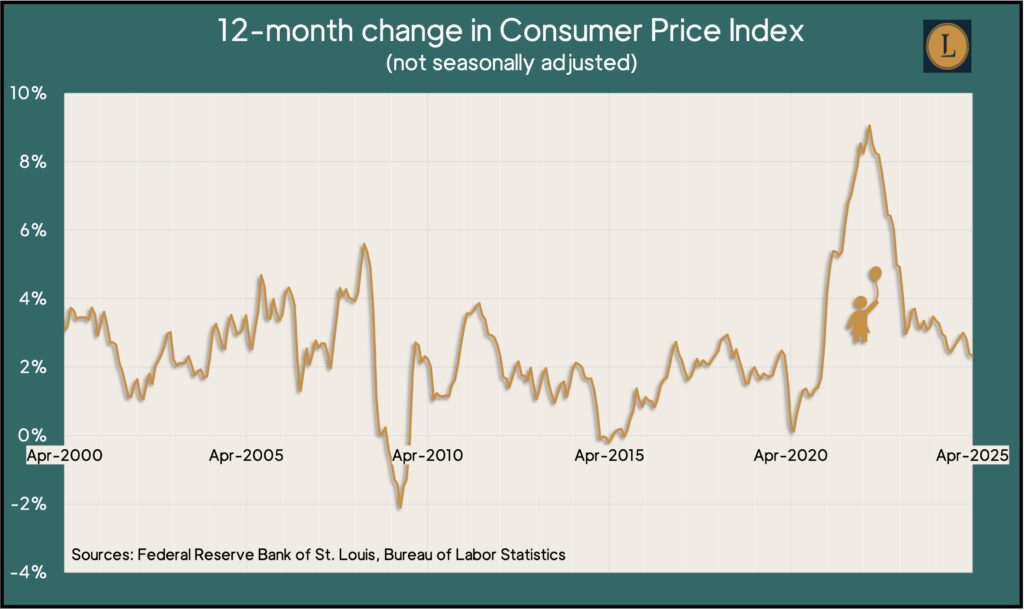

Broad inflation slowed in April to its lowest point in more than four years. The Bureau of Labor Statistics reported that its Consumer Price Index rose 2.3% from April 2024, still outpacing the Fed’s 2% target but down from a four-decade high of 9.1% in mid-2022. Shelter costs c0ntributed more than half of the month’s increase while grocery prices fell the most since mid-2020. Egg prices dropped nearly 13% from March but were 49% more expensive than they were in April 2024. The 2.3% year-to-year inflation rate was the lowest since February 2021. Excluding volatile costs for food and energy, the core CPI rose 2.8% from the same time last year, the same pace as in March.

Wednesday

No major announcements

Thursday

Inflation on the wholesale level registered a 2.4% annual increase in April, slowing for the third month in a row. The Producer Price Index was down 0.5% from March, the first decline in 16 months and the most since April 2020. The Bureau of Labor Statistics said the index shrank mostly because of lower prices for services, led by margins for machinery and vehicle wholesaling. The core rate of wholesale inflation, stripping out volatile prices for food, energy and trade services, sank 0.1% for the month and was up 2.9% from April 2024.

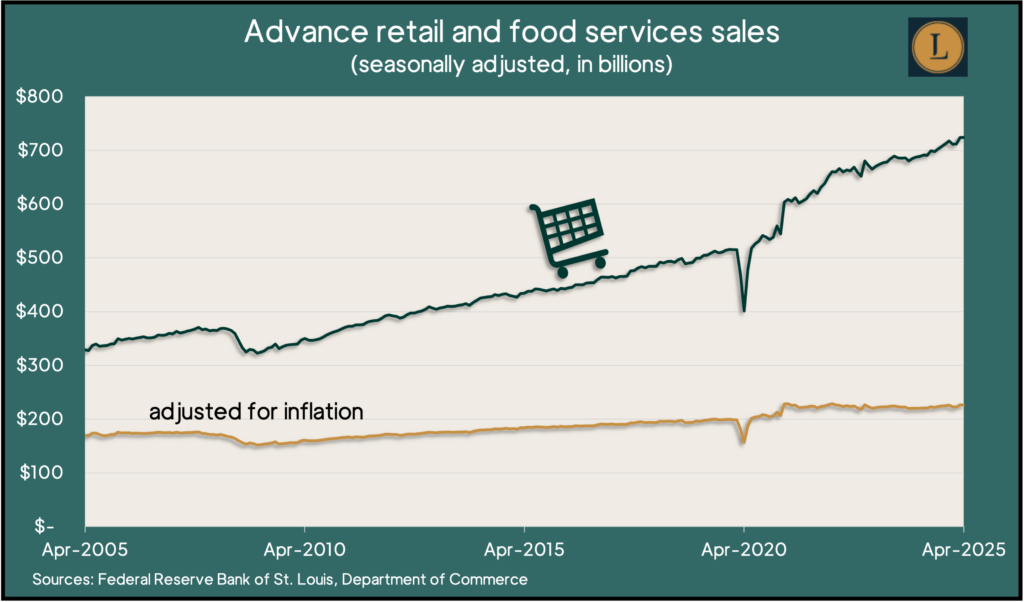

Retail sales slowed in April, though consumers kept spending, according to a report by the Commerce Department. Advanced sales by retailers and food services rose 0.1% from March. Among 13 major categories, five increased sales from the month before, including bars and restaurants. Sales at supermarkets and liquor stores were unchanged. Car dealers and gas stations were among the outlets where sales declined. Adjusted for inflation, retail sales fell 0.2% in April. Economists follow store signs as an indication of consumer spending, which drives two-thirds of the U.S. economy.

The four-week moving average for initial unemployment claims rose for the third week in a row, rising to its highest level since October. The measure of employer willingness to let workers go was 36% below the 58-year average, suggesting a continued tight labor market. According to Labor Department data, total jobless claims fell 3% from the week before to just under 1.9 million applications, which was nearly 6% higher than the year before,

The Federal Reserve said its industrial production index was unchanged in April, though 1.5% above where it stood the year before. Lower output from manufacturing and mining was offset by increased production by utilities following an unseasonably warm March. Factories produced 0.4% less than March and were up 1.2% from April 2024. Industry’s capacity utilization rate fell marginally to 77.7%, staying below the 52-year average of 79.6%. Seen as an early indicator of inflation, the capacity rate has been safely under the long-range average since late 2022.

Friday

Housing construction in April stayed in a relatively narrow band that has accompanied higher interest rates since mid-2022. A Commerce Department report on building permits and housing starts showed the indicators on par with levels in early 2007, just before the Great Recession. The number of houses under construction has been declining since late 2023 but remained near the housing boom peak of 2006. Economists have blamed a lack of inventory for years of escalating housing prices.

The University of Michigan said consumer sentiment sank slightly from the end of April following four months of sharp declines. Since January, sentiment was down nearly 30%. More consumers spontaneously mentioned tariff uncertainty as reasons for angst for the economy and their personal finances. The university said opinions brightened marginally after some tariffs were suspended temporarily in April. It said its month-end report should show any effects from more recent pauses on trade policies with China.

Market Closings for the Week

- Nasdaq – 19211, up 1283 points or 7.2%

- Standard & Poor’s 500 – 5958, up 298 points or 5.3%

- Dow Jones Industrial – 42655, up 1405 points or 3.4%

- 10-year U.S. Treasury Note – 4.44%, up 0.07 point