Podcast: Play in new window | Download

Landaas & Company newsletter March edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Adam Baley

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (March 20-24, 2023)

SIGNIFICANT ECONOMIC INDICATORS & REPORTS

Monday

No major announcements

Tuesday

The annual rate of existing home sales rose 14.5% to nearly 4.6 million in February, the first increase after 12 consecutive declines. Still, the pace was 23% slower than the year before, as higher mortgage rates have stifled activity. The National Association of Realtors said improved sales in February were most noticeable where mortgage rates and home prices softened and jobs were growing. Inventories remained near record lows, with only 2.6 months supply. The median sales price was $363,000, down 0.2% from the year before, the first time the year-to-year price fell in nearly 11 years.

Wednesday

The Federal Open Market Committee, the policy-making panel of the Federal Reserve Board, announced another 0.25 percentage point raise in the short-term fed funds rate. It was the ninth increase in the rate in the last year, raising it from nearly nothing to more than 4.5% in order to cool the overall economy and control inflation. The Fed reaffirmed its commitment to a long-range inflation rate of 2%. The broadly based Consumer Price Index reached 6% in February, having dropped from more than 9% in June. A word cloud of the Fed’s statement emphasizes words used by their frequency.

Thursday

Labor market conditions showed continued strength, with the four-week moving average for initial unemployment claims remaining 47% below the 56-year average. The indicator of employers’ reluctance to let workers go fell for the second week in a row, according to the Labor Department. Total claims dropped 3% from the week before to 1.9 million, which was up 4% from the same time the year before.

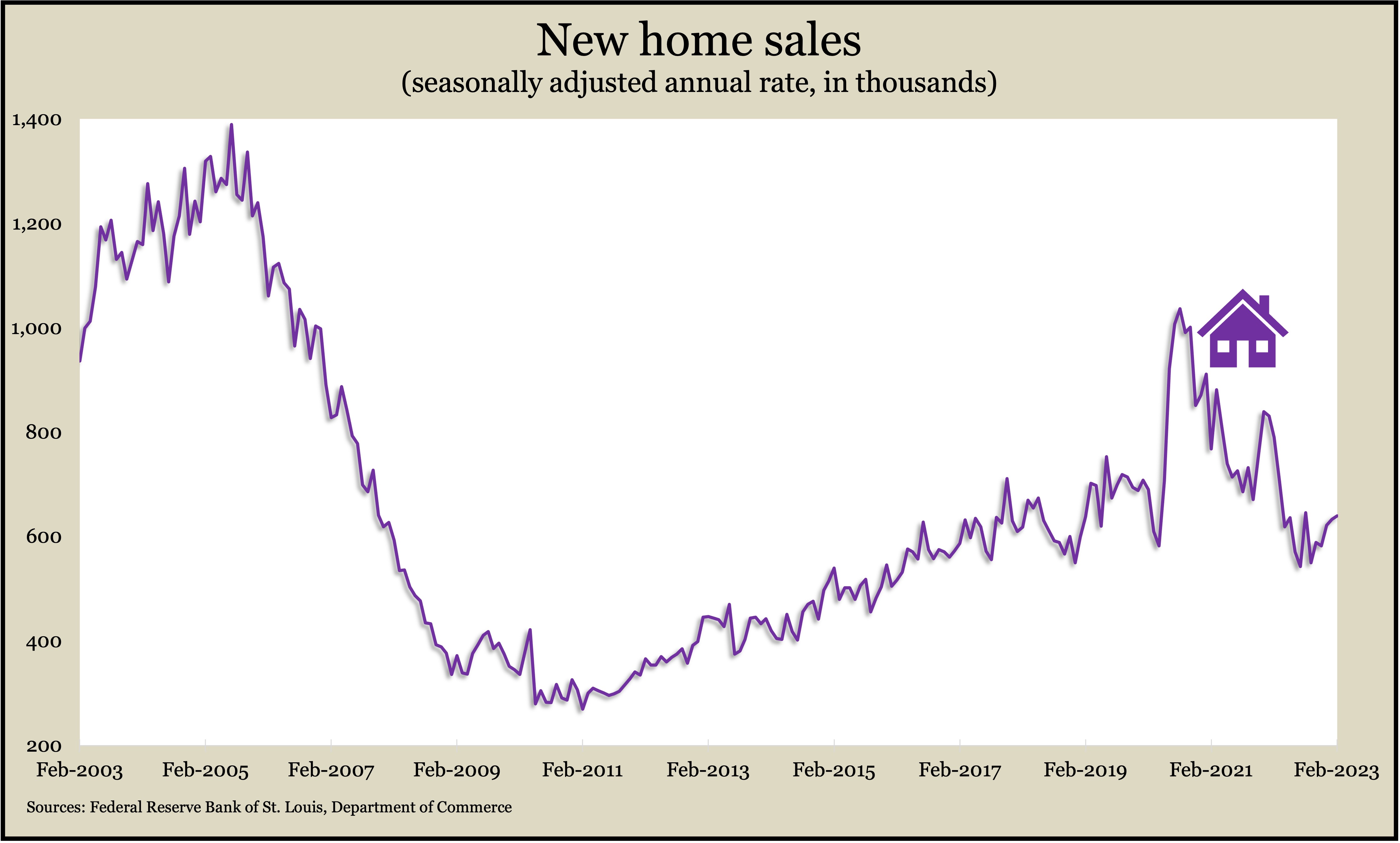

The Commerce Department said new home sales rose 1% in February from the January pace but were 19% behind where they were the year before. A joint announcement with the Department of Housing and Urban Development reported an annual sales rate of 640,000 new houses, marking the 10th month in a row below the pre-pandemic mark of 690,000. The median sales price rose to $438,200, a 2.5% increase from February 2022. The year-to-year median price declined in January for the first time since August 2020.

Friday

Demand for manufactured items showed overall resilience in February despite the third decline in durable goods orders in four months. Drops in orders for commercial aircraft and automotive products brought down the monthly headline figure from the Commerce Department, as total orders fell 1%. However, orders were unchanged from January when excluding volatile demand for transportation equipment. Compared to the year before, overall orders rose 2% while orders excluding transportation rose 1.9%. Orders for core capital goods, a proxy for business investments, increased for the second month in a row and were up 4.3% from February 2022.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 11824, up 193 points or 1.7%

- Standard & Poor’s 500 – 3963, up 47 points or 1.2%

- Dow Jones Industrial – 32231, up 369 points or 1.2%

- 10-year U.S. Treasury Note – 3.38%, down 0.02 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.