Money Talk Podcast, Friday Sept. 25, 2020

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter September edition now available.

Advisors on This Week’s Show

Bob Landaas

Kyle Tetting

Brian Kilb

Chris Evers

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Sept. 21-25, 2020)

SIGNIFICANT ECONOMIC INDICATORS & REPORTS

Monday

No major announcements

Tuesday

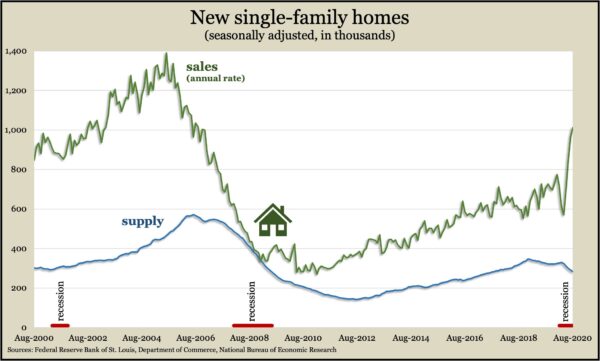

The annual rate of existing home sales rose 2.4% to 6 million in August, the highest level since the end of 2006. The National Association of Realtors said the rate rose three months in a row following steep drops related to the spring onset of the COVID-19 pandemic. With traditional mortgage rates hovering around 3% and surges in demand for upgraded work-from-home environments, the trade group said it expects home sales to continue strong for the rest of the year. A longstanding shortage of houses on the market kept escalating prices. The median price rose 11.4% from August 2019 for the 102nd consecutive year-to-year gain.

Wednesday

No major announcements

Thursday

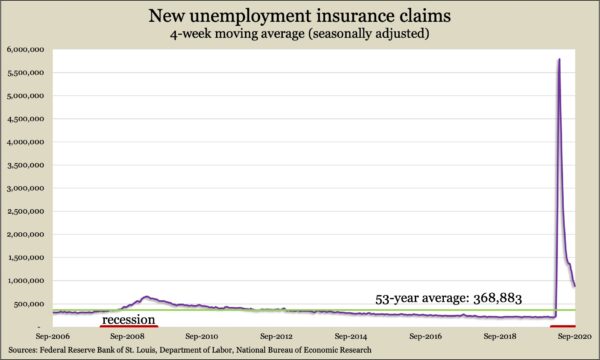

Leveling off in recent weeks, initial unemployment claims remained more than double their all-time average and more than one-third above their pre-pandemic average. Data from the Labor Department showed the four-week moving average declining in all but one week since reaching 5.8 million in mid-April. In all, 26 million Americans were receiving jobless benefits from one program or another, up from fewer than 1.5 million the year before.

The Commerce Department said new home sales reached an annual rate of more than 1 million in August, the highest since September 2006. Overall sales rose 4.3% from July’s pace and were up 43% from the year before. Sales rose 27.6% for houses whose construction had yet to be started, suggesting demand was outpacing supply. Based on the pace of sales, the supply of houses for sale would be enough for 3.3 months, the lowest in 57 years of data.

Friday

The Commerce Department said demand for manufacturing continued recovering in August, with durable goods orders rising 0.4% from July. It was the slightest of four consecutive monthly increases. New orders for long-lasting factory items rose 39% from their pandemically induced nadir in April, but they were still 5.4% below February. A proxy measure for business investment rose 1.8% from July but was down 1.4% from the year before.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 10914, up 120 points or 1.1%

- Standard & Poor’s 500 – 3298, down 21 points or 0.6%

- Dow Jones Industrial – 27175, down 483 points or 1.7%

- 10-year U.S. Treasury Note – 0.66%, down 0.03 point

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.