Money Talk Podcast, Friday Sept. 24, 2021

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter September edition now available.

Advisors on This Week’s Show

Kyle Tetting

Brian Kilb

Mike Hoelzl

Chris Evers

with Max Hoelzl, engineered by Jason Scuglik

Week in Review (Sept. 20-24, 2021)

SIGNIFICANT ECONOMIC INDICATORS & REPORTS

Monday

No major announcements

Tuesday

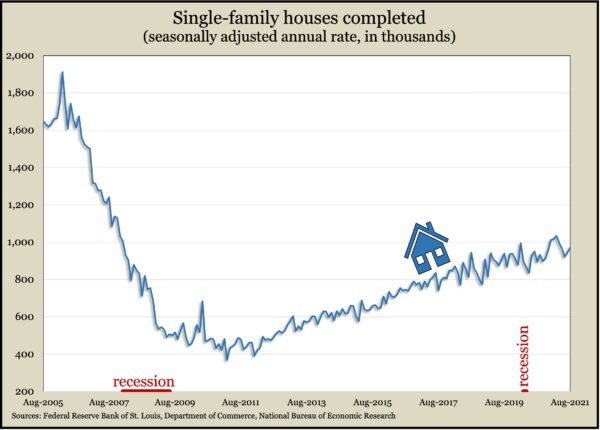

The U.S. housing industry picked up pace in August. Both housing starts and building permits accelerated, though both remained below recent 15-year highs. The annual rate of housing starts was up nearly 4%, but initiations of critical single-family houses declined almost 3% from July, the third drop in a row. Permits rose 6% from their pace in July to the highest rate in four months. Single-family permits were little changed after four monthly declines, according to Commerce Department data. However, completions of single-family houses rose for the second month in a row, hovering around levels last seen in 2007.

Wednesday

The annual rate of existing home sales fell 2% to 5.9 million in August, the second decline in three months and 1.5% below the year-ago pace. The National Association of Realtors said an ongoing lack of inventory continued to raise prices, causing an unbalanced market. The number of houses for sale dropped 1.5% in August to a 2.6-month supply, less than half of what economists have considered as sustainable. The median sales price of $356,700 was up 14.9% from August 2020, marking the 114th consecutive year-to-year increase in prices.

Thursday

Labor market conditions continued improving as the four-week moving average for initial unemployment claims declined for the sixth week in a row, reaching 10% below the all-time average. Data from the Labor Department showed the moving average of 335,7000 new applications was still 60% above where it was just before the pandemic but down from a record 5.3 million in April 2020. In the latest week, 11.2 million Americans were receiving jobless benefits from one program or another, down 7% from the week before. About 75% of the claims were through expiring pandemic relief programs.

The Conference Board’s index of leading economic indicators rose 0.9% in August, advancing from gains of 0.8% in July and 0.6% in June. The business research group said the delta variant of COVID-19 as well as inflation concerns could lower the economy’s “rapidly rising trajectory” in coming months, but it continued to project robust growth rates of 6% in 2021 and 4% in 2022.

Friday

The Commerce Department said the annual pace of new home sales rose 1.5% in August, the second consecutive gain, though still down 24.3% from the brisk rate of August 2020. Regional differences in sales ranged from up 26% in the Northeast to down 31% in the Midwest. The supply of new houses on the market remained around six months’ worth. The median price rose 17% from the year before to $380,900. Only 30% of the houses sold for less than $300,000, vs. 43% in August 2020.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 15048, up 4 points or 0.0%

- Standard & Poor’s 500 – 4456, up 23 points or 0.5%

- Dow Jones Industrial – 34798, up 213 points or 0.6%

- 10-year U.S. Treasury Note – 1.46%, up 0.09 point

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail.