Money Talk Podcast, Friday Sept. 10, 2021

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter September edition now available.

Advisors on This Week’s Show

Bob Landaas

Kyle Tetting

Brian Kilb

Mike Hoelzl

Chris Evers

(with Jason Scuglik)

Week in Review (Sept. 6-10, 2021)

SIGNIFICANT ECONOMIC INDICATORS & REPORTS

Monday

Markets and government agencies closed for Labor Day

Tuesday

No major releases

Wednesday

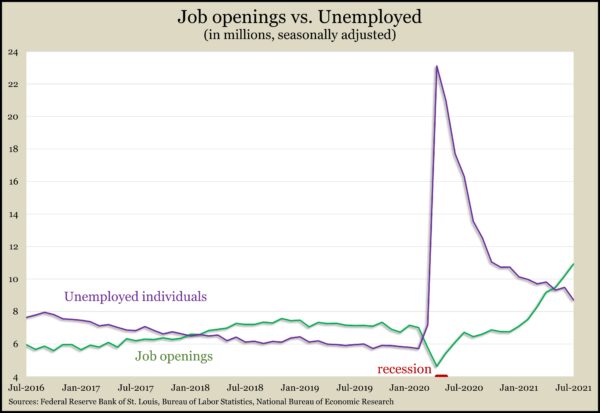

U.S. employers posted a record 10.9 million job openings in July, up nearly 750,000 from June, with nearly a third in health care and social assistance. Data from the Bureau of Labor Statistics showed demand for workers continued to outpace the number of Americans out of work and seeking jobs. Figures on hiring, layoffs and firing changed little from June. About 4 million workers quit jobs, remaining near a record high, indicating the level of confidence workers have in finding new positions.

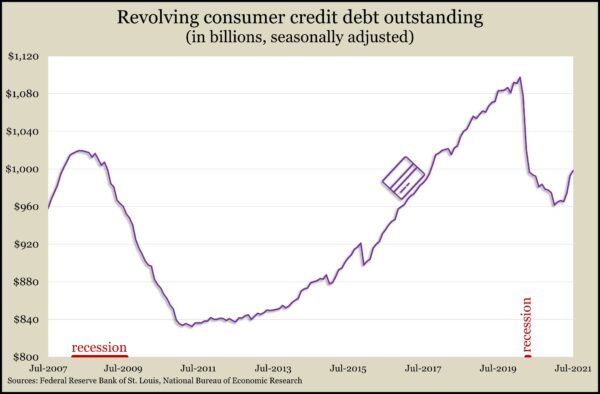

The Federal Reserve reported that credit card debt rose at an annual rate of 6.7% in July, the fifth increase in six months. An indicator of consumer spending, which drives about 70% of the U.S. economy, the level for credit card borrowing was down $99 billion or 9% from its pre-pandemic peak. It took 10 years to recover from the Great Recession, unadjusted for inflation. Total consumer debt, including student loans and vehicle financing, rose at an annual rate of 4.7% in July to reach 2.7% above its pre-pandemic level.

Thursday

Initial claims for unemployment insurance continued to decline from record levels in the pandemic. The four-week moving average dropped to 339,500, the lowest since the week of March 14, 2020, and 9% below the average level since 1967, according to Labor Department data. Total claims for jobless benefits fell 2% from the week before to nearly 12 million. About 9 million of those claims were tied to pandemic relief benefits expiring this month.

Friday

The producer price index rose 0.7% in August, outpacing analysts’ consensus estimate of 0.6% but below the July increase of 1.0%. From a year-over-year perspective, the PPI rose 8.3% up from 7.8% in July and the highest since data was first calculated in 2010. Primary drivers of the wholesale inflation indicator were higher costs for transportation, beef, industrial chemicals and beauty supplies.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 15115, down 248 points or 1.6%

- Standard & Poor’s 500 – 4459, down 77 points or 1.7%

- Dow Jones Industrial – 34607, down 762 points or 2.2%

- 10-year U.S. Treasury Note – 1.34%, up 0.02 point

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.