Money Talk Podcast, Friday Jan. 19, 2018

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter January edition now available.

Advisors on This Week’s Show

Bob Landaas

Kyle Tetting

Marc Amateis

(with Max Hoelzl and Joel Dresang)

Week in Review (Jan. 16-20, 2018)

Significant economic indicators & reports

Monday

Markets and government offices closed for observation of Martin Luther King Jr. Day

Tuesday

No significant releases

Wednesday

The Federal Reserve reported that industrial production gained in December for the third time in four months, despite a weak showing for manufacturing. Utilities and mining led the monthly gain. The Fed said industries expanded output by an annual rate of 8.2% in the fourth quarter, partly driven by a rebound following hurricanes Harvey and Irma. For the year, industrial production increased 3.6%, the largest year-to-year gain since 2010, the first full year after the recession. The same report showed capacity utilization, a leading indicator of inflationary pressure, rose to its highest point since February 2015 but stayed well below its long-term average.

Thursday

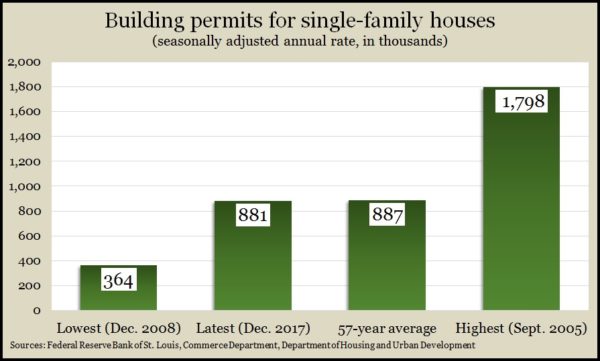

The pace of home building stalled in December, according to the Department of Commerce. Housing starts were on a 1.19 million-unit annual pace, down 8.2% from November’s pace and down 6% from December 2016. The rate remained above recessionary levels but was less than half of the 2005 peak. The same report – whose figures are volatile month-to-month – showed a slower pace for building permits, although mostly because of declines in multi-family housing projects. Authorizations for single-family houses have risen four months in a row and reached the highest rate since August 2007. That suggests a continued moderate pace in housing starts, which housing economists say is not keeping pace with demand.

The moving four-week average for initial unemployment claims fell for the first time in five weeks, as data settle from the ebb and flow of temporary year-end holiday hiring. The leading indicator of firings and layoffs remains 31% below the 50-year average, where it has been each week since the beginning of 2013, according to Labor Department data. That suggests employers continue to be reluctant to let workers go, a sign of labor market strength that should help fuel consumer spending.

Friday

A preliminary look at January consumer sentiment from the University of Michigan surveys suggested Americans are feeling slightly less confident about economic conditions. Overall sentiment remains near 17-year highs, according to the university’s longstanding index. In particular, consumers are relatively content with their personal financial situations and short-term spending plans. Consumer spending accounts for more than two-thirds of U.S. economic activity.

Where the Markets Closed for the Week

- Nasdaq – 7,336, up 75 points or 1.0%

- Standard & Poor’s 500 – 2,810, up 12 points or 0.4%

- 10-year U.S. Treasury Note – 2.64%, up 0.09 point

- Dow Jones Industrial– 26,071, up 268 points or 1.0%

Send us a question for our next podcast.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.