Money Talk Podcast, Friday Feb. 3, 2023

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter February edition now available.

Advisors on This Week’s Show

Kyle Tetting

Steve Giles

Paige Radke

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 30-Feb. 3, 2023)

Significant Economic Indicators & Reports

Monday

No major reports

Tuesday

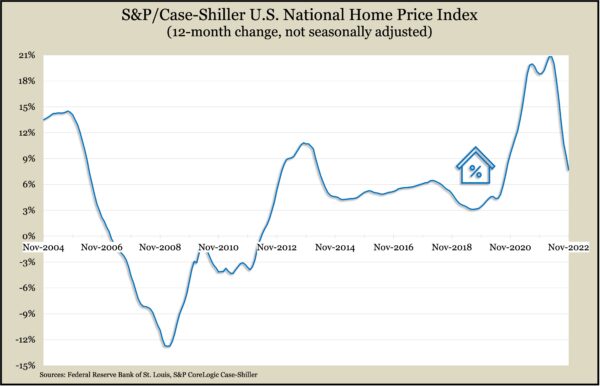

In the face of rising mortgage rates and a slowing economy, home prices continued to decline in November. According to the S&P CoreLogic Case-Shiller home price index, the year-to-year increase in prices decelerated for the eighth month in a row, dropping to a 7.7% gain in November, down from a record peak of nearly 21% in March. A spokesman for the index said further interest rate increases from the Federal Reserve and the possibility of recession should put a further damper on home prices.

The Conference Board said lower opinions of current economic conditions sent the consumer confidence index down in January. The business research group said survey responses suggested the U.S. will suffer a recession within the year. It said confidence had dropped mostly among younger households with lower incomes. At the same time, overall expectations for incomes, purchases and inflation held relatively steady from December.

Wednesday

The manufacturing sector contracted in January for the third month in a row, the Institute for Supply Management reported. The trade group said its index, based on surveys of industry purchasing managers, reflected declining output trying to match up with nine months of weakening demand. At the same time, the employment component grew for the second straight month with managers saying they want to be prepared for a comeback in orders in the second half of the year.

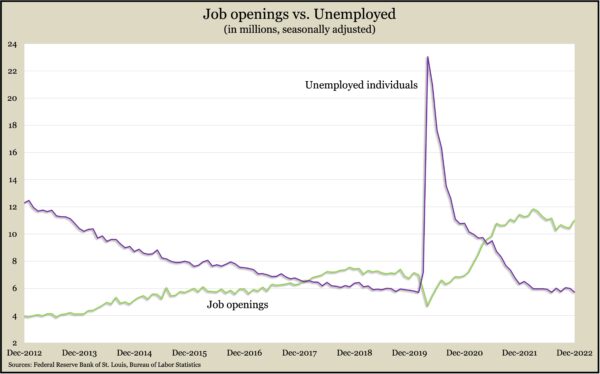

The gap between the number of job openings and unemployed job seekers reached a record high of 5.3 million in December, the most in five months, according to a Bureau of Labor Statistics report. Employers posted 11 million job openings in December, up from 10.4 million in November, led by hotels and restaurants, retailers and construction companies. In December, nearly 4.1 million workers quit their jobs, down marginally for the third time in four months but still indicating worker confidence in finding new positions.

Housing led a 0.4% decrease in construction spending in December. A Commerce Department report showed it was the first decline in four months. Residential expenditures, which make up about half of all spending, dropped off for the month but were up almost 2% from the year before. Government spending on construction fell 0.4% in December but was up 12% from December 2021.

Thursday

The four-week moving average for initial unemployment claims fell for the eighth week in a row, reaching its lowest level since last May. Reflecting employer resistance to letting go of workers in a historically tight labor market, the moving average was 48% below the average since records began in 1967. The Labor Department said the total number of Americans claiming jobless benefits declined 2% from the week before to 1.9 million, down from 2.2 million the year before, which was down from 18.5 million at the same time in 2021.

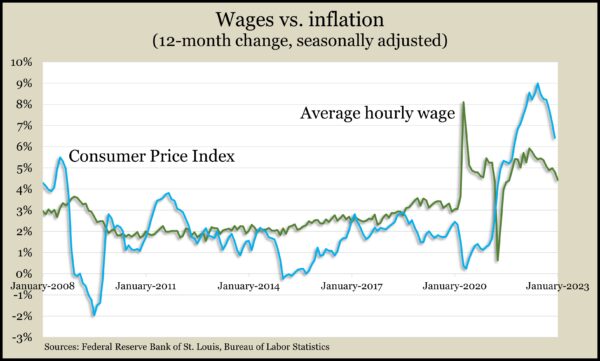

The Bureau of Labor Statistics said worker productivity rose at an annual rate of 3% in the fourth quarter, the swiftest pace in a year. The productivity rate resulted from rises of 3.5% in output and 0.5% in hours worked. Although recent quarters suggest productivity is increasing, on average, it sank 1.3% for all of 2022, the poorest showing since 1974. Unit labor costs rose 5.7% in 2022, the most in 40 years.

The Commerce Department said factory orders rose 1.9% in December, the fourth increase in five months, largely because of a rebound in orders for commercial aircraft. Excluding transportation equipment, orders sank 1.2% from November and were up 10.3% from the year before. A proxy for business investments fell 0.1% for the month and was up 8.3% from its year-earlier level.

Friday

The U.S. labor market strengthened in January after months of slowing. Employers added 517,000 jobs, according to payroll data from the Bureau of Labor Statistics. The bureau revised November and December reports to show that employers added 71,000 more jobs in those months than previously reported. Hiring rose by the most in six months, exceeding the 2022 monthly average of 401,000. Leisure and hospitality employers added the bulk of jobs in January but were still 495,000 or 2.9% lower than their pre-pandemic level. The unemployment rate dipped to 3.4%, the lowest since May 1969. Despite signs of a tightening job market, the 12-month raise in average hourly wages decelerated for the seventh time in nine months, dropping to 4.4% from a recent high of 5.9% last May.

The U.S. services sector grew again in January after contracting in December. An index from the Institute for Supply Management showed new orders rising dramatically from the month before. The trade group said its surveys of purchasing and supply managers provided mixed perspectives, with an overall positive outlook. Survey respondents cited improved capacity and logistics in addition to increased demand.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 12007, up 385 points or 3.3%

- Standard & Poor’s 500 – 4136, up 66 points or 1.6%

- Dow Jones Industrial – 33926, down 52 points or 0.2%

- 10-year U.S. Treasury Note – 3.53%, up 0.01 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.