Money Talk Podcast, Friday Feb. 24, 2023

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter February edition now available.

Advisors on This Week’s Show

Kyle Tetting

Adam Baley

Tom Pappenfus

(with Jason Scuglik, Joel Dresang)

Week in Review (Feb. 20-24, 2023)

Significant Economic Indicators & Reports

Monday

Markets closed for Presidents Day

Tuesday

The National Association of Realtors reported that existing home sales slowed in January for the 12th month in a row. The annual sales rate fell to 4 million houses, down less than 1% from December’s pace but 37% below its level of 6.3 million in January 2022. The trade association contended that sales have bottomed out, citing growth in places with lower home values. Inventories rose slightly from December but remained less than half the level considered sustainable to balance supply and demand. The median sales price, $359,000, was up about 1% from the year before, marking the 131st consecutive year-to-year gain.

Wednesday

No major releases

Thursday

The four-week moving average for initial unemployment insurance claims rose for the second week in a row following nine consecutive declines. The level was 48% below the 56-year average, according to new Labor Department data. The level returned to where it was just before the COVID-19 pandemic. Barely 2 million Americans claimed jobless benefits in the latest week, just below the year-earlier level but down from nearly 20 million claims at the same time in 2021.

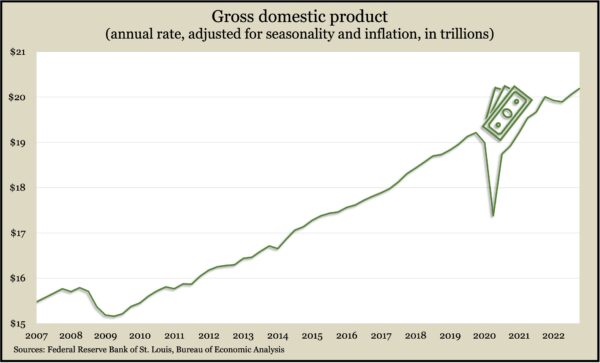

The U.S. economy rose slightly less than initially estimated in the fourth quarter, with gross domestic product expanding at a 2.7% annual rate. The Bureau of Economic Analysis said consumer spending, which drives about two-thirds of economic activity, rose at an annual rate of 1.4% from October through December, down from an initial estimate of 2.1%. Business investments, particularly in software, were stronger than initially estimated. Imports, which offset economic growth, declined less than estimated. For all of 2021, the economy grew by 0.9%, adjusting for inflation. It was up 6.3% from its peak just before the pandemic.

Friday

The Commerce Department said new home sales rose in January to an annual rate of 670,000 houses. That was up 7% from December’s rate but 19% behind the 831,000-house pace in January 2022. The median price for a new house was $427,500, down nearly 1% from the year before, marking the first time since August 2020 that the year-to-year comparison declined. The number of new houses for sale in January fell for the fourth month in a row.

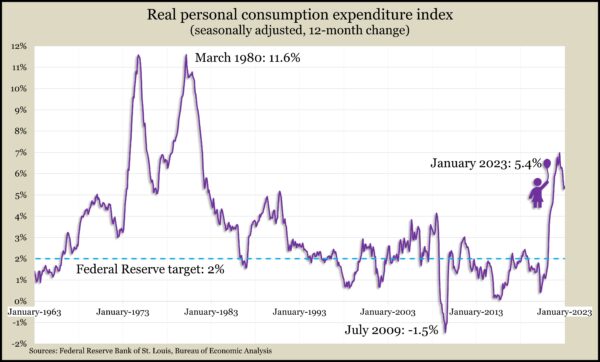

The Bureau of Economic Analysis showed consumer spending rising in January for the first time in three months and at the highest rate since the March 2021 federal stimulus payment. Expenditures increased 1.8% while personal income rose 0.6%. After adjusting for inflation and taxes, January was the fourth month in a row for income to outpace spending. As a result, the personal saving rate rose for the fourth month straight. The Federal Reserve’s main gauge of inflation stayed well above its long-range target of 2%. The year-to-year inflation rate hit 5.4% after hitting 5.3% in December, which was down from a 41-year high of 7% in June.

A precursor to spending, consumer sentiment, ticked up for the third month in a row. The University of Michigan said its survey-based index remained closer to its all-time low in June than to the historical average. Improved outlooks toward current economic conditions mostly boosted overall sentiment, the university said, especially among wealthier stockholders. Ongoing uncertainty over inflation prompted a forecast of unstable expectations for the near future.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 11395, down 392 points or 3.3%

- Standard & Poor’s 500 – 3970, down 109 points or 2.7%

- Dow Jones Industrial – 32817, down 1010 points or 3.0%

- 10-year U.S. Treasury Note – 3.95%, up 0.12 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.