Money Talk Podcast, Friday Feb. 17, 2023

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter February edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Kendall Bauer

(with Jason Scuglik and Joel Dresang)

Week in Review (Feb. 13-17, 2023)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

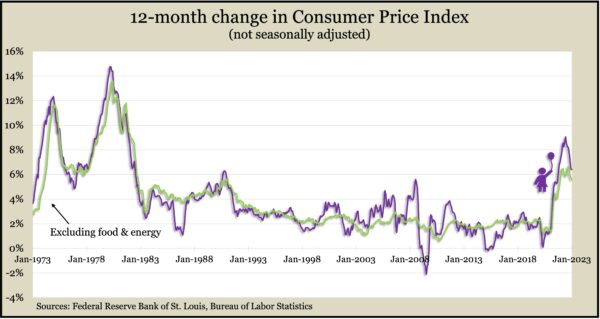

The broadest measure of U.S. inflation showed the pace continued to ease in January. The Bureau of Labor Statistics said its Consumer Price Index rose 6.4% from January 2022. The rate was down for the seventh month in a row after hitting a 41-year high of 9.1% in June, but it was still far above the Federal Reserve’s long-range target of 2%. Shelter costs accounted for about half of the 0.5% increase in the index from December. Food and energy prices also contributed to the monthly gain. Excluding volatile food and energy costs, the core CPI rose 5.6% from the year before, the fourth monthly decline after a recent peak of 6.6% in September.

Wednesday

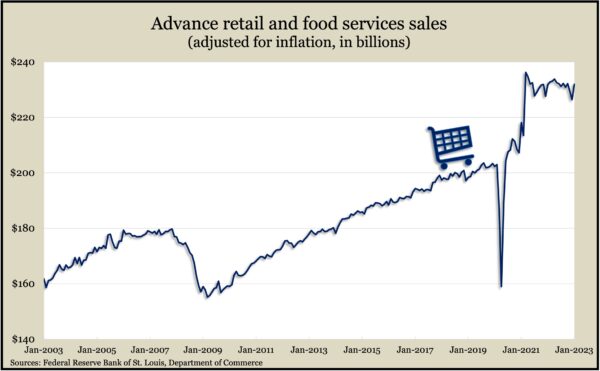

Suggesting revived consumer demand, retail sales rose 3% in January, the first increase in three months. The Commerce Department reported that all 13 major retail categories increased revenue in January, led by bars and restaurants and car dealerships. Only electronics and appliance stores posted a decline from the year before, when sales overall rose more than 6%. Since January 2022, sales at bars and restaurants jumped 25%. Total retail sales adjusted for inflation also rose for the first time in three months but remained below the peak set last March.

The Federal Reserve reported no change in industrial production in January as utilities suffered from an unseasonably warm month following an unseasonably cold December. The falloff in utilities output offset the first gains in three months from both manufacturing and mining. Overall industrial output has not had a monthly gain since September. Industries’ capacity utilization rate fell for the fourth month in a row and for the second consecutive month stayed below the 50-year average. High capacity rates can indicate rising inflation.

Thursday

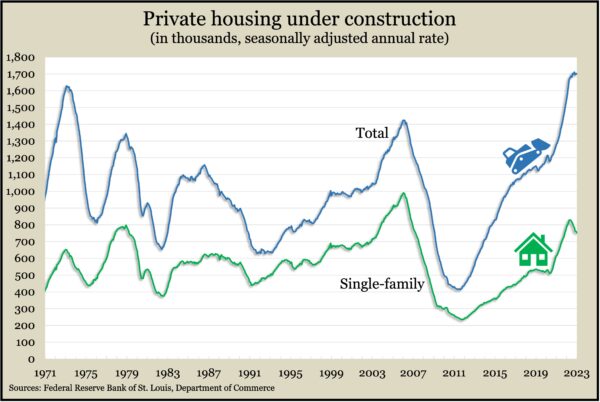

The Commerce Department showed continued weakening in housing in January, as the annual rate of building permits and housing starts trended lower, below pre-pandemic levels. Permits, which indicate plans for future construction, were 8% under where they were in February 2020, with authorizations for single-family housing slowing for the 11th month in a row. Housing starts slipped more than 4% from December, with new single-family construction down 19% from its pre-pandemic pace and 36% behind December 2020, which was the highest point since before the financial crisis. The annual rate of houses under construction also declined slightly in January but remained near record levels.

The four-week moving average for initial unemployment claims rose for the first time in 10 weeks. An indication of employers’ reluctance to let go of workers, the rolling average stayed 49% below the 56-year average and was near its all-time low, reached last April. Total jobless claims rose less than 1% from the week before to 1.9 million, compared to nearly 2.1 million the year before and 18.9 million claims at the same time in 2021.

Inflation on the wholesale level rose 0.7% in January, reversing a slight decline in December. Prices for goods gained more than those for services. The Bureau of Labor Statistics said the Producer Price Index increased 6% from the year before, the slowest pace since March 2021, down from a peak of 11.7% last March. The core PPI, which excludes volatile prices for food, energy and trade services, rose 0.6% for the month and 4.5% from the year before, also the lowest 12-month gain in nearly two years.

Friday

U.S. economic growth slowed in January, though not as much as in December. Still, the Conference Board said its index of leading economic indicators suggests a recession in 2023. The index was down 3.6% in the latest six months, compared to a 2.4% contraction in the six months prior. The business research group said indicators led by the yield curve signal a downturn this year despite “robust” numbers on employment and personal income. Among the factors it said should contribute to a recession are high inflation, rising interest rates and weaker consumer spending.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 11787, up 69 points or 0.6%

- Standard & Poor’s 500 – 4079, down 11 points or 0.3%

- Dow Jones Industrial – 33827, down 42 points or 0.1%

- 10-year U.S. Treasury Note – 3.83%, up 0.08 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.