Money Talk Podcast, Friday Dec. 3, 2021

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter December edition now available.

2021 Investment Outlook Seminar

Advisors on This Week’s Show

Bob Landaas

Kyle Tetting

Art Rothschild

Kendall Bauer

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Nov. 29-Dec. 3, 2021)

Significant Economic Indicators & Reports

Monday

Residential real estate sales appear to be headed for a 15-year high, according pending home sales data in October from the National Association of Realtors. The trade group’s index on contract signings indicated a 7.5% rise in commitments in October, though it was down 1.4% from the annual rate in October 2020. The Realtors forecast full-year sales in excess of 6 million fo 2021. And while low inventory has been pushing prices higher, the group said demand stays robust because of rising rents and expectations for higher mortgage rates.

Tuesday

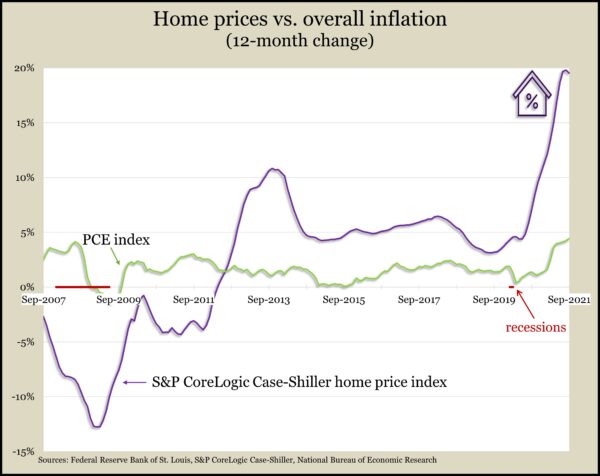

Hot housing prices cooled their pace slightly in September, with the year-to-year increase slipping to 19.5% from a record 19.8% in August, according to the S&P CoreLogic Case-Shiller national index. Housing prices continued to far outpace the rate of overall inflation. An economist with the index said the latest data provided further evidence that COVID-19 pushed more urban apartment renters toward suburban home ownership. The spokesman repeated an observation that housing inflation may be slowing down.

Concerns about inflation and COVID-19 tugged down consumer confidence in November, the Conference Board reported. The business research group said even though Americans lowered their expectations for job prospects and income, their holiday spending should be relatively strong, and the economy should continue to expand into early 2022. What follows that, the group said, will depend on continued uncertainties over prices and the pandemic.

Wednesday

Manufacturing expansion picked up pace in November as purchase managers surveyed by the Institute for Supply Management expressed optimism 10 times for every comment of caution. The trade group’s manufacturing index signaled growth for the 18th month in a row. The report included “some indications of slight labor and supplier delivery improvement” amid ongoing historic challenges to supply chains caused by the market upheavals of the pandemic.

Housing led a 0.2% increase in the pace of construction spending in October, which reached another record annual rate, nearly $1.6 trillion. The Commerce Department reported residential spending — accounting for 49% of all construction outlays — rose 0.5% from the September pace and was up 16% from October 2020. Single-family housing jumped 23% from the year-ago pace. Spending on manufacturing construction rose 13% from October 2020 while expenditures for lodging declined 34%.

Thursday

The four-week moving average for initial unemployment claims fell for the eighth week in a row, dropping 36% below the 54-year average. A Labor Department report showed the average for first-time applications — a measure of layoffs — at its lowest point in the pandemic, though still 14% higher than just before employment plunged in March 2020. Overall, 2.3 million Americans claimed unemployment compensation in the latest week, down from 20.8 million the year before.

Friday

U.S. employers added 210,000 jobs in November, the least since December and less than half the monthly rate of 555,000 so far in 2021. Since April 2020, 18.5 million jobs have returned to the economy, still 3.9 million or 2.6% shy of the mark in February 2020. According to data from the Bureau of Labor Statistics, only transportation-and-warehousing and financial activities gained enough jobs to be above pre-pandemic levels. The leisure-and-hospitality field remained down 1.3 million jobs or 7.9% from before the pandemic. The bureau’s household survey showed the unemployment rate declining to 4.2% from 4.6% in October. That was down from a record 14.8% in April 2020. In February 2020, the rate was 3.5%, the lowest since 1969.

The service sector of the U.S. economy expanded in November for the 18th month in a row, at the fastest pace on records kept by the Institute for Supply Management. The trade group said its services index components for business activity and new orders also hit all-time highs. Purchase managers surveyed by the group reported ongoing challenges with capacity, labor, materials and logistics as customer demands continued to outpace supplies.

Despite a drop-off in requests for commercial aircraft, U.S. factory orders rose in October for the 17th time in 18 months. Orders were up 1% overall and 1.6% excluding the volatile transportation category. Since October 2020, total orders rose 17%; excluding transportation, orders rose 14%. Core capital goods orders, considered a proxy for business investments, rose 0.7% for the month and 16% from October 2020.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 15085, down 406 points or 2.6%

- Standard & Poor’s 500 – 4538, down 56 points or 1.2%

- Dow Jones Industrial – 34580, down 320 points or 0.9%

- 10-year U.S. Treasury Note – 1.34%, down 0.14 point

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.