Money Talk Podcast, Friday Aug. 6, 2021

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter August edition now available.

Advisors on This Week’s Show

Bob Landaas

Brian Kilb

Art Rothschild

Paige Radke

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Aug. 2-6, 2021)

Significant Economic Indicators & Reports

Monday

Despite continued growing pains, the manufacturing sector expanded in July for the 14th month in a row, though at a slower rate, according to the Institute for Supply Management. The trade group’s manufacturing index, based on surveys of industry purchase managers, showed ongoing struggles between rising demand and constraints such as short supplies of materials, rising commodities prices, transportation challenges and lack of workers.

The Commerce Department said homebuilding continued to raise construction spending in June, nearing all-time highs, unadjusted for inflation. At a seasonally adjusted annual rate of $1.55 trillion, construction spending was up 3.4% from its pre-pandemic level. Residential made up nearly half of total construction spending, vs. about 40% of the total in June 2020. Spending on public construction projects declined from the pace in May as well as the year before.

Tuesday

Demand for manufactured goods continued in June as factory orders rose for the 13th time in 14 months. Orders remained above their pre-pandemic level for the seventh month in a row, up 18.4% from June 2020, according to Commerce Department data. Requests for commercial aircraft led the orders, but even excluding transportation equipment, demand rose 1.4% from May and 13.7% from the year before. A proxy for business investments continued to set all-time highs, unadjusted for inflation.

Wednesday

The service sector of the U.S. economy grew in July at the fastest rate in 13 years of data, according to the Institute for Supply Management. The trade group’s service index showed expansion for the 14th month in a row after it contracted in April and May of 2020 for the first time in 11 years. Purchasing managers surveyed for the index reported continued growing pains as their businesses tried to keep up with demand unleashed by reopenings facilitated by COVID-19 vaccinations. The group said businesses have been impaired by materials shortages, inflation, logistics and labor pool constraints.

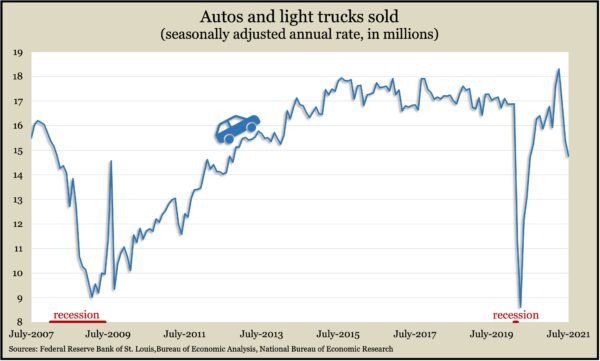

The Bureau of Economic Analysis reported the annual rate of motor vehicle sales declined in July for the third month in a row. Dealers sold at a pace of 14.8 million cars and light trucks in July, after a recent peak of 18.3 million in April. The latest pace is down 12.6% from the February 2020 rate of 16.9 million, just before the global pandemic. In April 2020, sales marked a low point in 45 years of data: 8.6 million.

Thursday

The U.S. trade deficit rose 6.7% in June to a record $75.7 billion, the Bureau of Economic Analysis reported. Imports also reached a new high, rising 2.1% from May, led by industrial supplies and consumer goods. Exports rose just 0.6%, signaling the relative strength of U.S. economic growth vs. trading partners abroad. Through the first six months of 2021, the gap between what the U.S. bought in goods and services and what it sold to the rest of the world grew 46.4%, with imports rising 21.3% and exports up 14.3%.

The four-week moving average for initial unemployment claims declined for the first time in three weeks to 394,000. The level was within 6% of the 54-year average, down from a record high of 5.3 million in April 2020 but up from a 52-year low of about 209,000 in February 2020. The Labor Department said nearly 13 million Americans claimed jobless benefits in the latest week, down 1.4% from the week before. About 73% of the total claims are tied to temporary pandemic assistance programs.

Friday

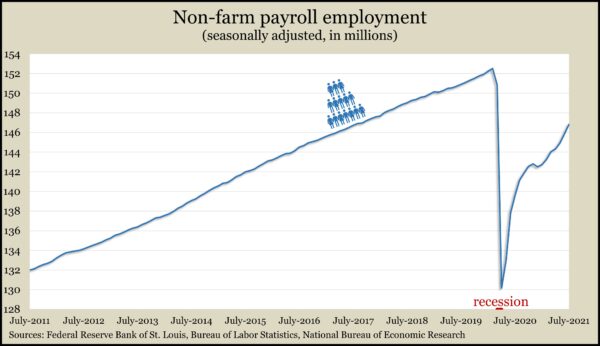

U.S. employers added 943,000 jobs in July, and the unemployment rate dropped to 5.4%, according to jobs data from the Bureau of Labor Statistics. The country remained 5.7 million jobs short of the level in February 2020. The leisure and hospitality sector accounted for 40% of the July job gains, and two-thirds of those jobs were at bars and restaurants. On the whole, leisure and hospitality had 1.7 million fewer jobs than before the pandemic. The 5.4% unemployment rate was down from a record high of 14.8% in April 2020. In February 2020, unemployment stood at 3.5%, the lowest since 1969.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 14836, up 163 points or 1.1%

- Standard & Poor’s 500 – 4437, up 42 points or 0.9%

- Dow Jones Industrial – 35209, up 273 points or 0.8%

- 10-year U.S. Treasury Note – 1.29%, up 0.05 point

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.