Money Talk Podcast, Friday Aug. 23, 2019

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter August edition now available.

Advisors on This Week’s Show

Bob Landaas

Kyle Tetting

Steve Giles

Paige Radke

(with Max Hoelzl and Joel Dresang)

Week in Review (Aug. 19-23, 2019)

Significant economic indicators & reports

Monday

No significant announcements

Tuesday

No significant announcements

Wednesday

Saying lower mortgage rates were drawing more home buyers into the market, the National Association of Realtors reported that existing home sales rose 2.5% in July. The annual pace of home sales increased to 5.42 million houses, which was up 0.6% from July 2018. An economist for the trade group said the real estate market still faces a shortage of lower-price houses for sale, suggesting that more should be built and that more apartments should be converted to condos.

Thursday

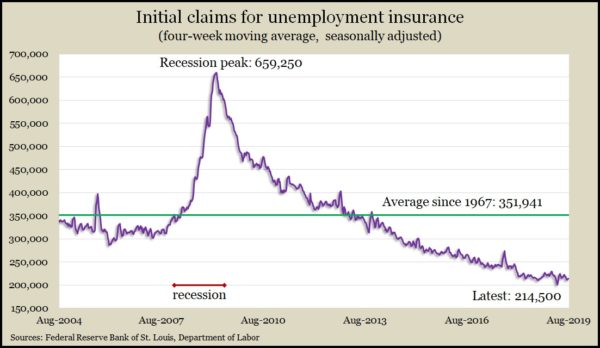

A report from the Labor Department showed the four-week moving average for initial unemployment claims rising for the third week in a row. The indicator of employer reluctance to let workers go has been below its 52-year average every week since 2013 and is one of the most persistent signals of the tight labor market. Demand for workers should empower more consumer spending, which drives about two-thirds of the U.S. gross domestic product.

The Conference Board said its index of leading economic indicators rose in July for the first time in three months. Continued low levels of jobless claims along with increased housing permits and higher stock prices led the reversal. Downward factors included weak manufacturing trends and a negative yield spread for the second month in a row. The business research group said the index suggests more moderate growth for the U.S. economy through at least the end of the year.

Friday

The annual rate of new home sales declined 12.8% in July, according to a report from the Commerce Department. A rate of 635,000 houses sold in April, which was 4.3% above the rate set in July 2018. The sales rate remained above the level reached just before the Great Recession started but was less than half the July 2005 peak. The number of months’ supply of new houses for sale rose to 6.4 from 5.5 in June and 6.2 in July 2018.

Market closings for the week

- Nasdaq – 7,752, down 144 points or 1.8%

- Standard & Poor’s 500 – 2,847, down 41 points or 1.4%

- Dow Jones Industrial– 25,630, down 256 points or 1%

- 10-year U.S. Treasury Note – 1.53%, down 0.01 point

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.