Student Loan Debt Impact

By Paige Radke

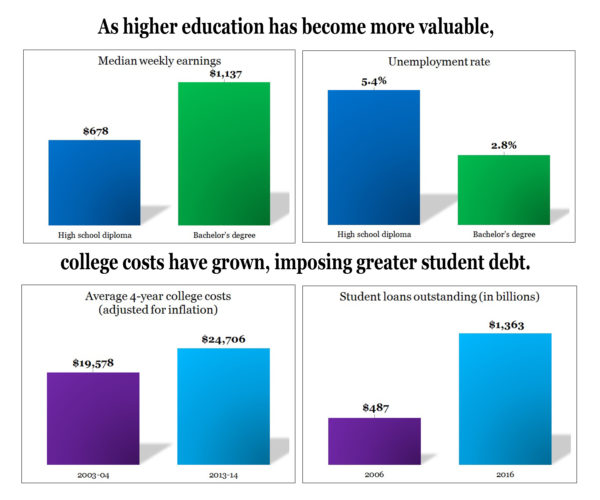

The increasing cost of college combined with the growing importance of higher education have caused unprecedented struggles with student debt. More than 70% of the class of 2015 funded college with loans compared to only about half the students 20 years ago.

College loan debt has had a significant impact on the millennial generation – born from 1981 to 1997 – as well as their parents. For many families, student debt is a shared burden that is altering the financial decisions of both the millennials as they launch their working careers and the parents as they approach retirement.

Parents

For the first time in history, young adults are more likely to live with their parents than any other living arrangement. Among Americans 18- to 34 years old, 36% are living with their parents. The top reason, according to the Investor Protection Institute: 64% say they are delaying major life steps because they have too much debt.

Parents are also helping their children pay down student debt. A study found that 24% of baby boomers are helping their children with student loans and other college expenses.

The financial dependence of the millennial generation is causing more parents to delay retirement. Those who support their children financially are less likely to be retired than those who do not. While wanting to help is understandable, parents need to encourage young adults to learn how to budget and manage life with debt.

What to do

Parents can help with their children’s financial stability while also making sure their children prepare for independence.

- Put yourself first. It can be hard to deny your offspring help, but make sure they understand the impact it has on your retirement. The years near retirement are when you should be lowering expenses and saving more. It is when your retirement picture should be getting clearer as a result of your planning. Do not let helping your children cloud your path.

- Make sure that the support you provide your children is productive. To avoid lasting financial dependence, help them make a plan to be independent. Set a deadline for it. Make sure they do not become complacent living at home.

- Consider having adult children at home pay a monthly fee that is less than what their expenses would be living on their own. The fee takes some of the financial burden off of you as parents while motivating your children to learn how to budget.

- Consider a loan. Instead of just giving children money, include a repayment plan. Again, your terms could be more generous than what they could find on their own, but you can teach them discipline and ensure that you get your money back over time.

Graduates

High student loan debt negatively impacts millennials’ ability to save for retirement. While 34% of millennials ranked saving as a top priority, 79% say paying down debt impedes their ability to save. Many are waiting longer to start saving, sometimes even waiting until after all their debt is paid down.

Alternate Repayment Programs

Income based: Payments are 10% of discretionary income

Graduated Repayment: Payments start low and increase over time

Automatic Repayment: Become eligible for a 0.25% rate reduction on loans

Waiting can have a serious impact on retirement savings. Consider the power of compounding. If someone starts saving $500 a month at age 22, they would have nearly double the amount of money at age 60 than someone who starts saving at age 32, assuming a 5% rate of return.

Also, generations of Americans have relied on home equity to build their net worth. Millennials living with their parents are losing out on chances to buy homes at near-record lows for mortgage interest rates.

Housing market dynamics have responded to this trend. Only 20% of new housing construction is entry-level compared with a 30% historical average. As a result, new homes are less available and less affordable for when millennials start buying homes.

What to do

- Explore your payback options. Federal student loan debt can be managed better with various alternate repayment programs. (Follow the links in the accompanying sidebar.) The programs allow recent graduates to arrange a plan that works best for them and their expectations for future earnings.

- In addition to putting a plan in place to manage and pay down debt, commit to saving a certain percentage of each paycheck for retirement. If you have a 401(k) matching program at work, try to put away at least as much as your employer matches.

- Make a budget that accounts for student loan expenses while not sacrificing saving for life after work. Use remaining earnings – after savings and debt payments – as a budget base.

By managing money this way, millennials are more likely to have enough saved up for lifetime milestones like buying a home and reaching retirement goals.

Sources for the illustration:

- Earnings and unemployment. Data are for Americans age 25 and over. Earnings are for full-time wage and salary workers. U.S. Bureau of Labor Statistics, Current Population Survey

- College costs. Average total tuition, fees, room and board rates charged for full-time undergraduate students. U.S. Department of Education, National Center for Education Statistics

- Student loans. Student loans owned and securitized, outstanding, comparing the second quarter of 2006 and the second quarter of 2016, not seasonally adjusted. Federal Reserve Economic Data

Paige Radke is a registered representative at Landaas & Company.

Resources

How to Repay Your Loans, from the U.S. Department of Education

Student Loans, from the Federal Trade Commission

Public Service Loan Forgiveness, from Federal Student Aid

Refinancing Calculator, from Student Loan HeroRead more

Parents: Put your retirement first, by Brian Kilb

Tough Love 2: Parenting your parents, by Brian Kilb

College finance: How much to help, by Isabelle Wiemero

You need a budget, by Tom Pappenfus

(initially posted Nov. 3, 2016)

More information and insight from Money Talk