Stock values: Looking forward to earnings

By Joel Dresang

Recent record highs across most major stock indexes tell investors that prices are up, but they don’t indicate value: Whether stocks are worth the price.

To measure value, investment professionals use a variety of tools, most commonly the price-earnings ratio, or P/E. The P/E shows how much it costs to get $1 worth of earnings from a company’s stock or from a number of stocks in a given index.

To get the P/E of the broad-market S&P 500 index, you divide the S&P 500 price by its earnings. Often, the earnings are expressed as actual net income that companies have already reported, but Dave Sandstrom notes that it’s more useful for investors to know how price compares to projected earnings. He points out that an investment’s potential matters more than its past.

“I kind of prefer the forward-looking P/E because I’d like to know what’s coming, what’s going to happen in the future,” Dave says in a Money Talk Video. “Although, you have to take that with a grain of salt because it is a projection.”

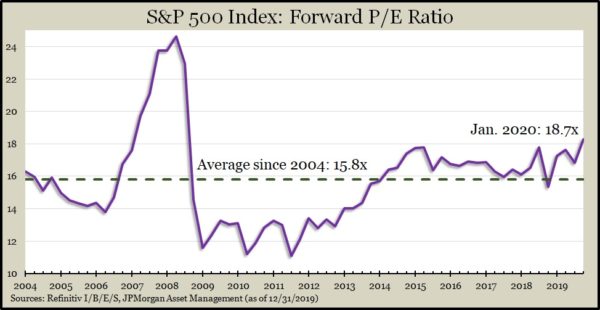

Based on the S&P 500 at the beginning of 2020, and using the 12-month earnings forecast at the time, the broad market had a P/E or earnings multiple of 18.3. That compares to a 15-year average of 15.8, according to Refinitiv, a markets data provider.

In other words, as 2020 started, the market was willing to pay 16% more than normal for each dollar of projected earnings in the S&P 500. In contrast, 2019 began with a multiple of 15.4, more than 2% below average.

What happened in 2019 was that stock prices—the P numerator of P/E—grew, while earnings—the E denominator—remained flat. That’s called an expansion of the multiple.

“Investors bid stock prices higher because they were more and more willing as the markets matured during the year to pay ever more money for one dollar of earnings,”

Bob Landaas explained in a recent Money Talk Podcast. “It seems to me that at this point in time the only thing that will take the market higher is earnings.”

As overvalued as it is, the S&P is running out of room for further expansion of the multiples, which sets the stage for earnings to catch up.

“Short term, there’s no reason why stock prices can’t dislocate from the earnings, but long term, prices and earnings tend to move pretty similar to each other. When earnings increase, stock prices tend to increase in a similar fashion,” Kyle Tetting responded to Bob in the same podcast. “So, the way you get back from elevated P/E ratios to more typical or more average P/E ratios is either by decreasing the numerator, that price number, or increasing the denominator, that earnings number—or both.”

Early projections from Refinitiv suggest S&P earnings growth of about 10% for 2020 and nearly 11% for 2021.

“Earnings estimates are guesses. They’re educated guesses,” Bob said. Still, there are reasons why earnings appear ready to rise:

- The Federal Reserve allayed year-ago concerns over rising interest rates by lowering rates three times in 2019 and then declaring that rates were pretty much where they need to be for a while.

- The U.S. and China have an initial settlement in what had been an escalating, temperamental trade war.

- Earnings, which are reported as year-over-year comparisons, have lower bars to clear from 2019, when earnings rose a mere 0.2% for the entire year.

“I think this is going to be the year for earnings,” Bob said. “I think it’s very unlikely that the multiples will expand from here, and it’s going to be one of those old-fashioned years where it’s going to be about earnings and interest rates.”

Joel Dresang is vice president-communications at Landaas & Company

Learn more

Multiple reasons for an exceptional 2019, by Kyle Tetting

5 things to do when stocks aren’t cheap, a Money Talk Video with Marc Amateis

Valuing investments: Price-earnings ratio, a Money Talk Video with Dave Sandstrom

Earnings Yield: Valuing Stocks vs. Bonds, a Money Talk Video with Kyle Tetting

Earnings, interest rates & valuations, a Money Talk Video with Brian Kilb

(initially posted Jan. 29, 2020)

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail.