Social Security: No do-over

By Lisa Lewitzke

Deciding when to start taking Social Security benefits could be one of the most important and complicated decisions you will ever make.

And, if you make the wrong choice and don’t realize it until 12 months after you’ve started receiving benefits, you are stuck without a do-over.

Social Security benefits play an important role in funding your retirement. Yet, many retirees make the decision to start taking their benefits without fully understanding all their options. Also, 64% begin taking payments before their full retirement age, which could cost them a big part of that asset.

With a complicated, one-time decision that could make a difference of thousands of dollars of retirement income, you cannot afford to take your Social Security election lightly. Seek help in determining what’s best for you and your family. To start, consider the following:

Do the math. Waiting can be worth it, if you can afford it.

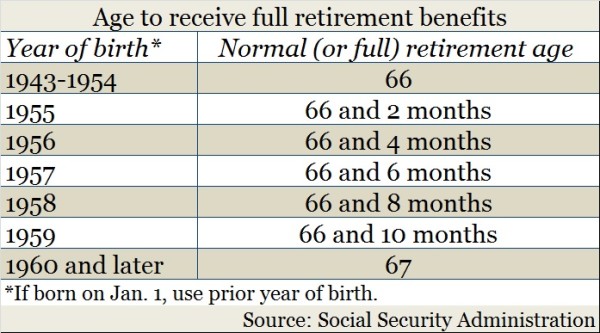

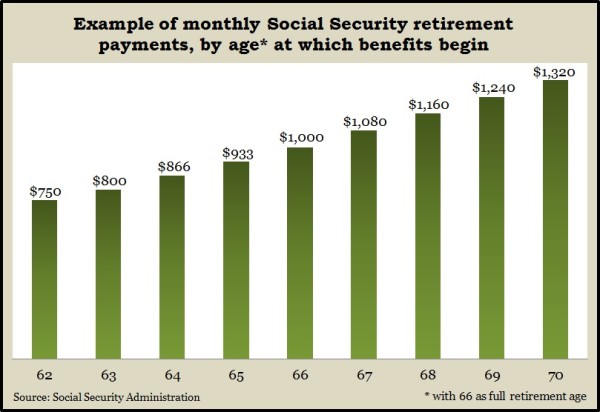

Holding off taking your Social Security benefit until after your full retirement age will earn you 8% delayed retirement credit for each year you wait. It would be hard to find a guaranteed rate like that in today’s markets. Delaying until age 70 would get you the largest possible benefit. If you are married, waiting until you’re 70 would result in the largest survivor benefit as well.

Be a team. Married couples have more options available. It’s important to consider all the strategies available to determine what works best.

Becoming familiar with the Social Security website – www.socialsecurity.gov – and talking with an experienced financial professional can help you greatly.

Working? Many people retire early but continue to work on a part-time or consulting basis. But if they claim Social Security before full retirement age, their earnings could be greatly reduced.

Up until 12 months before your full retirement age, for every $2 you earn over the current $15,720 limit, $1 is withheld from Social Security benefits. In the 12 months before you reach full retirement age, you lose $1 of benefits for every $3 you earn over a limit of $41,880.

Weigh the delay. Postponing your Social Security benefits can pay in the long run, but it costs you in the near term.

For instance, if your annual benefit would be $20,000 at a full retirement age of 66 and you waited one year to file, the benefit would increase to $21,600. So by waiting, you lose $20,000 for that first year and gain an extra $1,600 a year for as long as you live. It would take you 12.5 years at $1,600 a year to recover that $20,000. So your break-even point or crossover age is 79.5 (67+12.5).

Some may not want to wait 12.5 years for the deferral to pay off. If you are in poor health or don’t think you will live to the break-even age, waiting might not be worthwhile. Those early retirement years may be when some see themselves traveling and spending more money than they would at age 79. Therefore, it can make more sense not to delay.

Once you elect to start taking your Social Security benefits, your decision is irrevocable – with one exception. If you start taking your benefits and within the first 12 months realize it wasn’t the best choice, you can withdraw your application. You have to pay back all the benefits you received, but it allows you the one-time choice of applying again in the future for possibly a larger benefit down the road.

This is just the tip of the iceberg when it comes to Social Security planning. There are hundreds of different Social Security strategies to choose from, and you need to make sure you are picking what makes the most sense for you and your family. There are no cookie-cutter answers. What your neighbor or co-worker or in-law did might not be the best for you.

You’ve worked hard all your life to get to the next chapter. Take your time to clear the waters before jumping into the deep end.

Lisa Lewitzke is a registered representative and investment associate at Landaas & Company.

Learn more. Click for:

- A Social Security guide on when to start receiving retirement benefits

- Benefits calculators, from the Social Security Administration

- Frequently Asked Questions, from the Social Security Administration

- “When to Take Social Security Benefits: Questions to Consider,” from the National Academy of Social Insurance

(initially posted March 6, 2015; updated Nov. 17, 2015)

More information and insight from Money Talk