Shut down needless worries

Washington again is monopolizing headlines and airwaves. But investors need to remember the two things that matter most to long-term investing: Corporate earnings and interest rates. Dysfunctional politics has not changed those fundamentals.

Corporate profits have never been higher. Interest rates are near historic lows and should stay down at least into 2015 because the Federal Reserve figures that’s the soonest the U.S. economy will be strong enough to stand on its own.

Low interest rates favor equities. That’s a real simple concept. If CDs went to 10%, we’d all say “Thank you,” and stocks would get hammered. But with CDs currently paying less than 0.5%, there’s no competition for stocks. You can get a stock dividend four or five times that high.

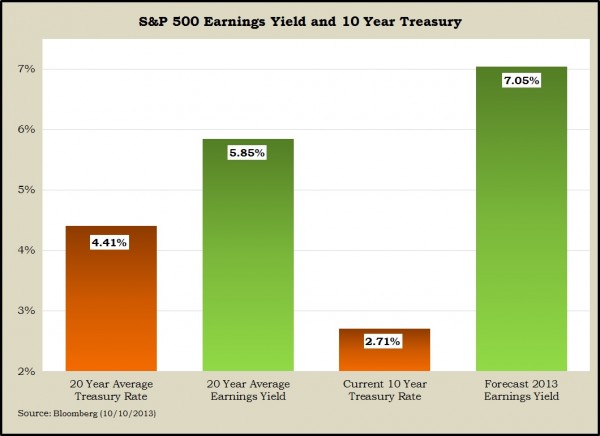

Compare the difference between the yield on the 10-year Treasury note and the earnings yield on equities (the inverse of the price-to-earnings ratio for the Standard & Poor’s 500 Index). Using this measure, the U.S. stock market remains quite attractive with the earnings yield 4.34 points higher than the 10-year yield.

Of course, that difference tells you that stocks offer a greater reward because they are riskier than bonds. But the answer for a long-term investor isn’t to avoid risk, it is to be extremely diversified – which includes investing in equities.

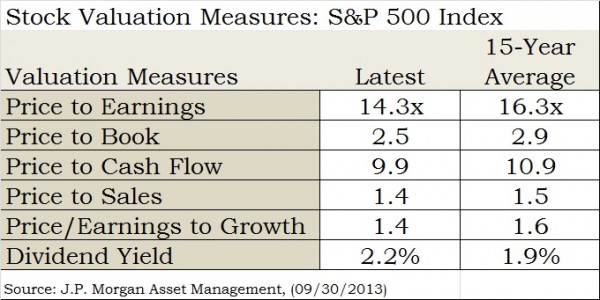

You’ll look smart if you invest based primarily on valuation – buying assets that are cheaply priced and are likely to rise in value. Stock valuations are higher than a year ago, but they still remain attractive in a historical context.

Whether you look at price-to-earnings, price-to-cash, price-to-sales, price-to-book – any of the traditional measures, stocks are either attractively priced or a little bit below average.

Bond yields have been unsustainably low. Some reversion to a more reasonable level makes sense. What’s been going on for the better part of 33 years is interest rates have been coming down. This is a long-term, secular trend, and it’s pretty easy to say that trend is over.

The cyclical pattern is less clear. As the economy struggles to try to meet some reasonable rate of growth, my guess is that interest rates are going to go up just gradually. The Fed itself has said it does not expect to raise short-term interest rates until 2015 – at the earliest.

There are only three ways for inflation to go up. As a result, there are only three ways that interest rates ultimately go up:

- Wages – The average family hasn’t kept up with inflation since 1991. Wages have dropped 6% on average since the financial crisis began. With unemployment as high as it is, I’m hard-pressed to understand how wages are going to be a threat.

- Commodities – In the summer of 2007, corn was selling for $9 a bushel. Now, it’s about half that. Without a big increase in commodities prices, producers aren’t going to be passing along higher prices to consumers.

- Capacity – We’re just below 78% of our capacity utilization. Historically, 81% is the point at which you have to worry about inflationary pressure. At some point, we’ll have to replace aging equipment, and business spending will get back into a normal cycle, and that will be inflationary. But the fact remains that growth in the U.S. remains moderate, and inflation remains tame.

These forces should limit the increase of interest rates.

It’s all about earnings and interest rates. If interest rates stay low, and analysts expect earnings to go up 10% the next couple of years and we’re at reasonable valuations for stocks, that tells me that there are good times ahead.

As little as anyone cares for what has been going on in Washington lately, I still see encouraging fundamentals for long-term investors.

Bob Landaas is president of Landaas & Company.

(initially posted Oct. 10, 2013)

More information and insight from Money Talk