2015 Investment Outlook Seminar Quiz

See how much you were paying attention to Bob Landaas at the latest client seminar. Or, if you weren’t there, learn what you missed.photo by Reuben Neese

Click here for the answers – AFTER you take the quiz.

View our video of the seminar by clicking here.

1) Which, if any, of the following is true?

- The U.S. economy has never been bigger.

- Private payrolls have never been greater.

- Household debt service is lower than usual.

- Bank lending has never been more generous.

2) Which of the following regions will account for the bulk of the world’s middle-class consumption by 2030?

- North America

- Europe

- Asia Pacific

- Central and South America

3) In noting that investors’ outlook might be brighter than some pundits let on, Bob referred to the “nattering nabobs of negativism.” He attributed the quote to:

- Ben Bernanke

- Yogi Berra

- Spiro Agnew

- Bill Gross

4) Bond prices move in the opposite direction of interest rates in proportion to the bond’s duration. Which of these formulas best illustrates that?

- (Change in Interest Rate) X (Duration) = Change in Price

- Earnings ÷ Price = Earnings Yield

- E = MC²

- Price ÷ Earnings = P/E ratio

5) Bob has been managing money for 40 years. For how many of those years have interest rates been going down?

- 5

- 12

- 23

- 35

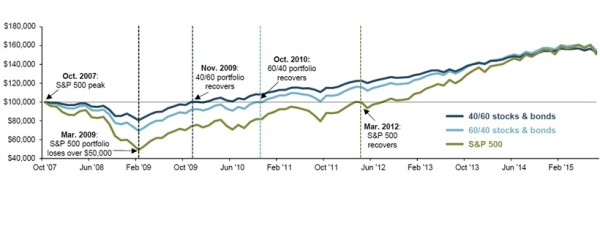

6) What is the main message for investors from the following graphic (via JPMorgan Asset Management)?

7) Which three of these economic indicators does Bob watch for signs of inflation?

- Wages

- National debt

- Capacity utilization

- Commodities prices

8) Which three of the following options did Isabelle Denton discuss as moves companies can make with their record $4.73 trillion in cash?

- Invest in other companies

- Give back to their shareholders

- Save for a rainy day

- Invest in their own operations

9) Name the two fundamental determinants of whether stock prices go up or down over the long run.

10) Based on Kyle Tetting’s presentation, which two of the following are approaches that active managers use to try to add value to a fund’s performance?

- Top-down – picking investments that fit in with overall themes.

- Side-to-side – filling a range of components that mimic a benchmark index.

- Bottom-up – focusing on the fundamentals of each security selected.

- In-and-out – regularly replacing investments with whatever performed best in the previous quarter.

In a prelude to Bob’s address, clients at the seminars viewed a new Money Talk Video in which Landaas & Company advisors discuss the importance of balance. Please click here to see that video.

(initially posted Oct. 9, 2015)

More information and insight from Money Talk