2021 Investment Outlook Seminar – The Answers

Please check your responses against the answers below.

VIEW THE 2021 INVESTMENT OUTLOOK SEMINAR VIDEO BY CLICKING HERE.

1.

In talking about signs of higher inflation earlier in 2021 and the belief that it’s only temporary, Bob Landaas advised investors to keep their eye on “the canary in the coal mine.” To what was he referring?

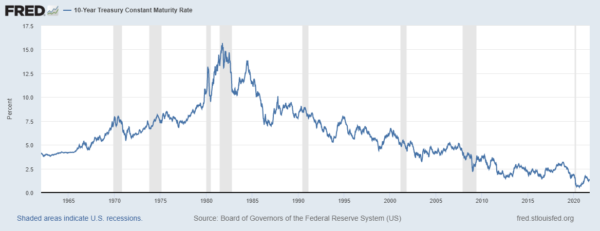

Answer: a. The yield on the 10-year Treasury note.

“If the yields start zooming, get nervous.” Bob said. Although it rose earlier in the year, following historic lows, it leveled off more recently and remains far below long-term averages.

Learn more

Stocks offset fears of inflation over time, by Joel Dresang

Fed efforts fail to fan inflation, a Money Talk Video with Kyle Tetting

—

2.

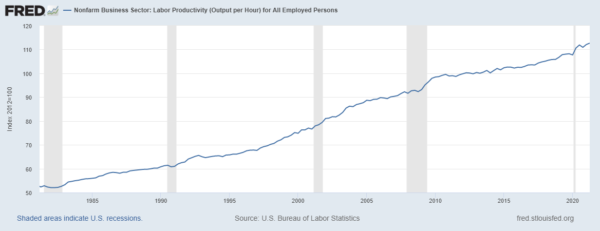

Bob and Kyle talked about the importance of productivity in continued economic growth. Output per hour worked stagnated in the last couple of decades following robust increases in the 1950s and ‘60s.

True or False? The pandemic-induced recession of 2020 appears to have further hindered productivity.

Answer: False.

Productivity has risen since mid-2020, which typically happens right after a recession. Companies tend to carry on with reduced staff and increase investments in labor-saving technologies. It’s hoped modifications imposed by the pandemic will boost productivity in the long run.

“Of course, we’re still in the infancy of artificial intelligence, augmented reality, machine learning and other wonderful technologies that eventually should come to fruition and help output,” Bob said. “It’s really one of the few ways to increase aggregate net worth in the United States: Have more workers and make them more productive.”

Learn more

Uneven recovery suggests balance, by Kyle Tetting

Snow day perspectives on stock forecasts, by Kyle Tetting

—

3.

Bob noted that international stocks have been lagging the performance of U.S. companies for years. Which of the following IS NOT among the points he and Kyle made in their discussion?

Answer: d. International stocks have no place in most American investors’ portfolios.

To the contrary, Kyle said geographical diversity can play a role a role in the mix and balance of investments.

“You want exposure to a variety of sources of risk, a variety of sources to potential return. That has to include, at a minimum, some of these opportunities we’re talking about outside the U.S.,” Kyle said.

Learn more

Investing away from home, by Kyle Tetting

Over there: Investing in a global economy, a Money Talk Video with Kyle Tetting

Global exposure via large U.S. companies, Money Talk Video with Marc Amateis

—

4.

As at every Investment Outlook Seminar, Bob and Kyle discussed the Efficient Frontier, which is essential to customizing investors’ asset allocations. Which of the following best summarizes the concept?

Answer: c. The mix of investments can vary depending on an individual’s need for returns and tolerance for risk.

“There is a sweet spot,” Kyle said. “There is a right place to be in terms of how much bonds do I have in my portfolio? How much stock do I have in my portfolio? How do those pieces fit together? That right mix changes a little bit over time. And it changes depending on who you are as an investor. But there is a right place to be, and it probably isn’t all or nothing.”

Learn more

Allocation to optimize reward vs. risk, a Money Talk Video with Dave Sandstrom

Efficiently allocating assets, a Money Talk Video with Steve Giles

Talking Money: Efficient Frontier

—

5.

Dave Sandstrom spoke with Kyle about the positive developments of greater market breadth in recent stock rallies. What did he mean by market breadth?

Answer: c. The number of companies participating

Dave points out that in both stock rallies and declines, the number of companies participating can indicate how much a market movement is considered a broader trend rather than something limited to just a handful of stocks or a narrow sector.

Learn more

Support for stocks, beyond the calendar, by Kyle Tetting

Concentrated gains, broad participation, by Kyle Tetting

—

6.

Paige Radke spoke with Kyle about how common it is for stocks to experience corrections in which indexes such as the S&P 500 decline by 10% or more from their previous high.

Which of the following WAS NOT among the actions Paige said investors might consider when corrections occur?

Answer: b. Minimize effects of the correction by fleeing from stocks ASAP.

“Always have in mind what your portfolio should look like, what level of risk you’re able to stomach,” Paige said. “Frequent rebalancing is going to be what keeps you there. The other thing that you want to do is make sure that you have diversified assets within your portfolio. You have to remember that not all assets are going to react the same when the market does go down.”

Learn more

Correction: A normal part of investing, a Money Talk Video with Marc Amateis

Market corrections: Always be prepared, a Money Talk Video with Brian Kilb and Marc Amateis

—

7.

Chris Evers spoke with Kyle about ways to measure potential risk in investments. Two technical tools are beta, which compares an investment’s volatility to a broader index, and standard deviation, which measures how much an investment’s returns vary.

According to Chris, what’s a major drawback of those tools?

Answer: a. They’re based on past history.

“All they really can incorporate is things that have occurred in the past that have affected the prices of those assets,” Chris explained. “So, they’re not always great at forward looking or handling unprecedented situations that maybe haven’t happened in price in the past.”

Learn more

Beta: Learning how risky an investment might be, a Money Talk Video with Kyle Tetting

Talking Money: Measuring risk/reward, a Money Talk Video with Kyle Tetting

Investment insights via Snapshot, a Money Talk Video with Tom Pappenfus

—

8.

Kyle talked with Kendall Bauer about historically low interest rates and how investors have been tempted to reach for higher yield for the bond side of their portfolios through bonds of longer duration and lower credit quality.

Which of the following WAS NOT a point made by Kendall and Kyle?

Answer: d. Higher-yield bonds will get less risky as interest rates rise.

“Bonds are your safe money,” Kendall said. “When you’re looking at building a properly balanced well-diversified portfolio, you want to take your risk on the stock side of the portfolio. The bonds are there as your safety net.” That safety net, he said, provides investors the confidence needed to take the risks of investing in stocks.

Learn more

Investor trade-off: Risk vs. return, a Money Talk Video with Paige Radke

Higher yield, junky risks, a Money Talk Video with Brian Kilb

Bonds also face investment risks, a Money Talk Video with Tom Pappenfus

—

9.

Kendall also noted that investors need to consider more than just yield. He said there’s a second component to total return that can often be overlooked.

To what was Kendall referring?

Answer: b. price appreciation

“Price appreciation has been the driving factor for many clients’ returns over the last ten years or so, being that interest rates have been so low,” Kendall said. “So often, yield gets the focus, and people want to home in on that. But it pays to take a step back and look at the total equation — being yield and price appreciation — when talking about total return.”

Learn more

Get the total picture of your investments, a Money Talk Video with Paige Radke

Talking Money: Total return, by Paige Radke

—

10.

Mike Hoelzl spoke with Kyle about investors being clear and up to date about the individuals they name as beneficiaries to their accounts. He noted that investors should specify individuals as beneficiaries on retirement accounts, such as IRAs and 401(k)s.

What reason did Mike give for the importance of naming beneficiaries?

Answer: c. It helps make sure money is disbursed as the investor wishes.

Mike also encourages investors to communicate clearly with their beneficiaries to help prepare them for what they stand to inherit.

“Because when they inherit the money, they’re going to have a lot of questions,” Mike said. “So, the more clear and concise answers you can give them, the better off they’ll be.”

Learn more

5 tips for naming beneficiaries, a Money Talk Video with Mike Hoelzl

When Should I …check my beneficiaries?

seminar references

(initially posted October 1, 2021)

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail.