2018 Investment Outlook Seminar – The Answers

Congratulations for completing the 2018 Investment Outlook Seminar Quiz. Please check your responses against the answers below.

View the seminar video by clicking here.

1. Bob Landaas noted that the Federal Reserve is likely halfway through raising short-term interest rates. Which one of these DOES NOT follow?

b) Reach for higher yield with lower-quality bonds.

In fact, Bob advised to seek higher quality in bonds. For what lower-quality bonds have been paying out, investors haven’t been compensated enough for the greater risk involved – especially considering that bonds are supposed to be part of the less risky side of a balanced portfolio.

Learn more by viewing “Ignore bonds at your own risk,” a Money Talk Video with Kyle Tetting, and “Be patient holding bonds as rates rise,” a Money Talk Video with Steve Giles

2. In the 2017 seminar, Bob spoke of synchronized global growth as a bright spot for the U.S. economy. Which one of these WAS NOT among his 2018 updates on the topic?

c) Except for China, global economies remain synchronized, thanks to the U.S. dollar.

Global growth has been slowing at the same time the U.S. economy has been gaining momentum. China is leading the slowdown abroad.

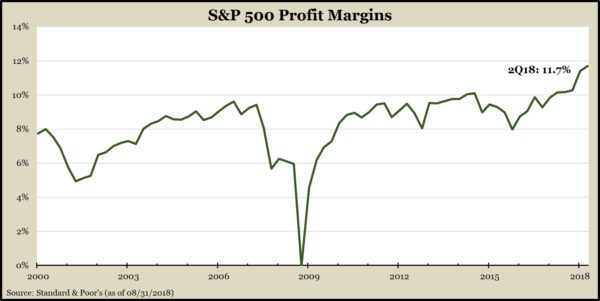

3. In his updates on U.S. stocks, which of the following WAS NOT a point that Bob explained?

b) Profit margins are narrowing.

Actually, profit margins usually do narrow late in business cycles, but margins have continued to rise, helping to sustain corporate earnings.

4. Which one of the following IS NOT a reason to believe that the longest bull market in history can continue?

d) The yield curve is flattening.

In fact, an inverted yield curve is a possible predictor of recession. Bob explained why the current movement in the curve might be less worrisome than in the past.

Learn more by viewing “How interest rates are shaping up,” a Money Talk Video with Kyle Tetting.

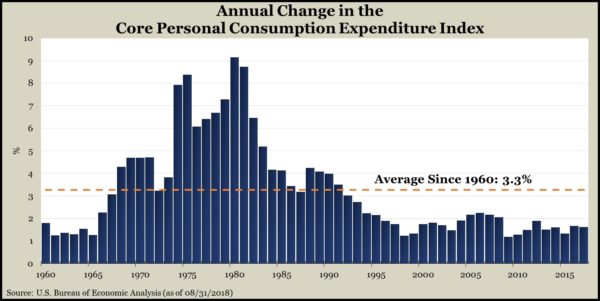

5. Despite signs for continued economic expansion, Bob advised clients to start preparing for the next downturn. Which of these IS NOT a reason to be cautious?

d) Inflation already is high, which could force interest rates much higher.

While a majority of past recessions resulted from inflation-fueled interest rate increases, Bob said inflation is a non-issue, at least for now. Various indicators, including the Federal Reserve’s favorite measure, show inflation below average.

Learn more by viewing “Investment lessons from the last downturn,” a Money Talk Video with Steve Giles

6. In his 43 years advising investors, Bob never before saw growth stocks outperform value stocks in a 30-year comparison. Which of these DOES NOT follow?

a) Growth stocks tend to hold up well in market sell-offs.

To the contrary. As a rule, growth stocks “sink like rocks” when markets deteriorate, Bob said, explaining why investors should limit their enthusiasm for growth stocks.

Learn more by viewing “Retaining value in your stock portfolio,” a Money Talk Video with Marc Amateis.

7. Which is Bob’s preferred price-earnings ratio to use when valuing the stock market?

b) Forward P/E – price divided by the 12-month forecast of earnings

Learn more by viewing “5 things to do when stocks aren’t cheap,” a Money Talk Video with Marc Amateis.

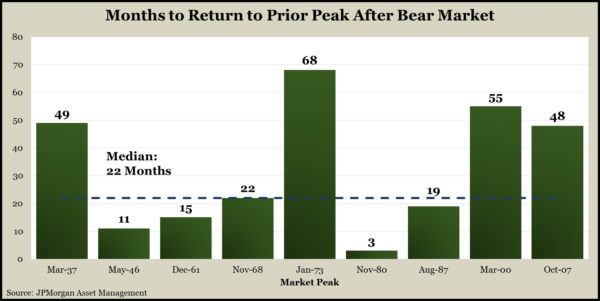

8. Why did Bob share this chart on bear markets?

b) To suggest keeping 40% of a retirement portfolio in relatively safe investments.

As Bob noted, keeping 40% of a portfolio in lower-risk bonds should cover 10 years of 4% annual withdrawals, which would outlast prior bear markets and give stocks time to recover.

Learn more by viewing “Deciding which retirement accounts to tap,” a Money Talk Video with Dave Sandstrom.

9. Bob suggested several considerations investors should remember to keep their portfolios balanced. Which one WAS NOT on his list?

a) As long as profit margins are high, increase your portfolio’s share of stocks.

In fact, Bob said to consider moving portfolios below 60% in stocks.

10. Which equity market has experienced the best performance over the last nine years?

c) U.S.

Bob showed U.S. stocks rising 320% since the 2009 market trough, vs. 200% for Japan, 150% for the emerging markets and 64% for Europe.

Learn more by viewing “Global exposure via large U.S. companies,” a Money Talk Video with Marc Amateis.

(initially posted October 5, 2018)

Also from the seminar

Selections important to your investments, a Money Talk Video with Kyle Tetting

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail.