Ask Money Talk – spending vs. saving

Listener Question: We hear that consumer spending is down and that’s bad for economic growth. But isn’t it good that the rate of personal savings is rising? Which side should we cheer for?

I think we should cheer for both. It’s what’s called the paradox of thrift.

You want people to save. One of the reasons we got into the financial mess that we got into was overleveraging and people spending money they didn’t have, borrowing against their homes.

But on the other hand, you do need people to spend money. Seventy percent of our economic activity is driven by the consumer.

So you need both. And it’s finding that happy medium and having the policies and the right environment in place to have that happy medium that is so difficult.

As an offshoot of our weekly podcasts – and to encourage your participation – we regularly feature responses to listeners’ questions.

Here’s an edited transcript of a recent podcast discussion with Landaas & Company advisors Marc Amateis, Margaret Schumacher and Brian Kilb.

Click here to send us your questions about financial trends and investment strategies.

This is one of the toughest big-picture questions out there right now.

Many people enjoyed the run-up to the financial crisis. Many people enjoyed the type of bubble we were in, where there was a lot of money available. You were able to live a lifestyle perhaps that you would otherwise not have been able to afford without that free access to money and easy debt.

On the other hand, yes, we do need to increase our savings rate, but it has an impact on your lifestyle. And I think Americans are going to have to wrestle with this one. It’s a tough one.

Everything that has happened in the past few years all comes back to the concept of deleveraging and erasing our mistakes of buying too much and borrowing too much.

Certainly, we have to save more. And I think the net result of that – domestically at least – is that we have to spend less.

The key issue is what Marc referred to as finding that happy medium.

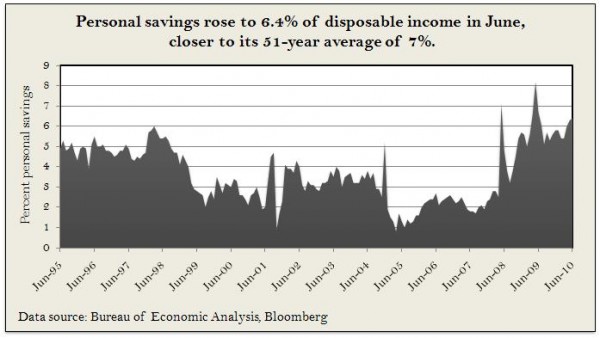

We were saving at a 0% rate. Now we’re back up at the 6% rate. So we’re saving more. We’ve had a number of months of consumer debt declines. So we’re certainly paying off our credit cards and minding our business a little bit better.

A big fear would be that instead of saving 6% we’re saving 9% or 10% and we’re overreacting and consumer spending drops so much that it forces the economy back into retrenching. That hasn’t happened yet.

I think we’ve found kind of a nice balance here. We’re starting to save more. We’re starting to do a better job as individuals. But we haven’t done so much of it that we’ve ruined the economy in the process.

initially posted August 19, 2010