High Frequency Trading

By Marc Amateis

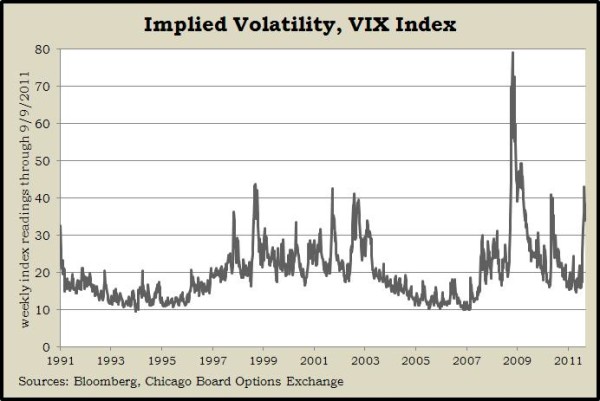

In one week this August, the Dow Jones Industrial Average had an unprecedented four consecutive days of 400 point price swings. Over the entire month, the S&P 500 stock index rose or fell more than 2% on more than half of the trading days.

This extreme volatility can be unsettling for investors, and there are many factors that contribute to it. One of those factors is the growth in what is called “high frequency trading” or HFT.

This type of trading is done primarily by large trading firms and investment banks. These entitites care nothing about the intrinsic value of a stock; their sole mission is to capitalize on a stock’s price movement, up or down. Banks of computers using mathematical formulas trade on market momentum, buying and selling in seconds. By some estimates, HFT now accounts for 70% or more of daily trading volume.

There is nothing illegal about this type of trading, and in fact it may perform a service by increasing liquidity and lowering transaction costs for other investors. However, one study found that high frequency trading clearly amplifies the ups and downs of price movements, and that can have an adverse effect on investor confidence in the fairness of the markets.

The most important consideration when dealing with market volatility, whether caused by HFT or something else, is time horizon.

To think that an ordinary investor can beat a bank of computer servers at the short-term trading game would be naïve. The investing environment has been changed, probably permanently. But if one’s time horizon is long enough, the day-to-day volatility in the markets becomes meaningless.

For all of the nerve-wracking volatility so far in 2011, the first eight months were almost a non-event. It turns out the Dow Industrials lost 58 points over that time period, for a whopping 0.5% decline.

Investors should understand that while high frequency trading will continue to feed market volatility, they need not let it affect their long-term investing goals.

Marc Amateis is vice president of Landaas & Company.

initially posted Sept. 20, 2011