Economic SnapChart

By Adam Baley

Seven months through 2016, the health of the U.S. economy remains stable, and the risk of recession remains low. Growth is expected to continue plodding along at a moderate pace.

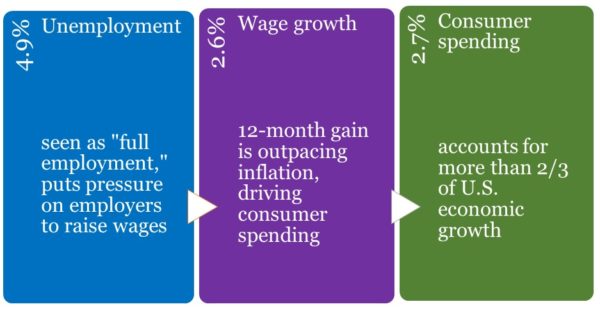

With a 4.9% unemployment rate, we have reached the textbook definition of “full employment.” That puts pressure on wages, which are up 2.6% year-over-year and are growing faster than inflation. Rising inflation-adjusted wages remain a key driver of long-term economic growth because income fuels consumer spending.

About SnapChart

Landaas & Company provides this occasional glance at a current economic trend to help keep investors informed on some of the factors that can affect financial markets.

Consumer spending is growing at 2.7% annually, after adjusting for inflation. With more than two-thirds of our economy generated by consumer spending, continued consumer strength should help sustain reasonable expansion at a time when the global economy overall is slowing.

Inflation rose 1.6% in the last 12 months, which is below the Fed’s 2% target. Historically, runaway inflation ends economic expansions, but seven years into this business cycle, inflation remains in check.

The implications for investors remain straightforward: Maintain a majority allocation in stocks for long-term growth and an appropriate weighting in high-quality, intermediate-term bonds for the confidence to hold on to stocks during periods of short-term turbulence.

Long-term, the stock market moves on interest rates and earnings. Interest rates remain low, inflation is low, and businesses buoyed by U.S. economic growth are still profitable – making a relatively healthy environment for long-term investors.

The numbers

- 4.9% unemployment rate, seasonally adjusted, June 2016, Bureau of Labor Statistics

- 2.6% annual gain in average hourly earnings for private payroll employees, from June 2015 to June 2016, Bureau of Labor Statistics

- 1.6% annual inflation rate, Personal Consumption Expenditures Index, excluding food and energy, May 2015 to May 2016, Bureau of Economic Analysis

- 2.7% annual gain in personal consumption expenditures, May 2015 to May 2016, Bureau of Economic Analysis

Adam Baley is a registered representative and investment advisor at Landaas & Company.

(initially posted July 28, 2016)

More information and insight from Money Talk