Money Talk Podcast, Friday Sept. 4, 2015

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter September edition now available.

Advisors on This Week’s Show

Brian Kilb

Dave Sandstrom

Kyle Tetting

(with Max Hoelzl and Joel Dresang)Week in Review (Aug. 31-Sept. 4, 2015)

Significant economic indicators & reports

Monday

No major releases

Tuesday

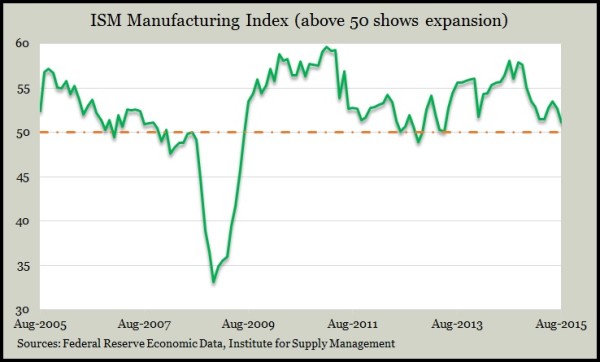

U.S. manufacturing showed signs of expansion in August, for the 32nd month in a row, according to the Institute for Supply Management. The trade group’s index declined to its lowest level since May 2013, with 10 of 18 industries reporting growth. Most components indicated slower growth, but exports actually contracted for the third month in a row, tying its lowest level since the recession.

More insulated than manufacturing from global economic challenges, U.S. construction spending in July reached its highest rate since May 2008. The Commerce Department showed particular strength in residential spending, especially single-family houses. Overall, the annual rate of construction spending grew by 13.7% from July 2014. That’s up from a 12% year-to-year comparison in June.

Americans bought motor vehicles in August at a faster pace than any month since June 2005. Auto Data Corp. said dealers sold an annual rate of 17.8 million vehicles for the month, up 1.5% from July and up 2.8% from August 2014. Trucks led the sales growth, with imported vehicles selling faster than U.S.-made. The brisk demand for autos suggests continued momentum for consumer spending, which accounts for more than two-thirds of U.S. economic growth.

Wednesday

U.S. factory orders rose for the second month in a row in July, although less than analysts had expected. Still, data from the Commerce Department suggest manufacturing was holding up against weak global economic conditions. Orders declined after factoring out volatile transportation categories, including automotive. Still, an indicator of increased business investments picked up for the second straight month.

The Bureau of Labor Statistics said productivity rose at a 3.3% annual rate in the second quarter, rebounding from a weak showing in the first three months of the year. Since the second quarter of 2014, productivity gained a mere 0.7% while unit labor costs rose 1.4%, reflecting a longer trend of slack output that possibly could lead to wage boosts and efficiency investments.

Thursday

The U.S. trade deficit narrowed to $41.9 billion in July, the result of increased exports and lower imports, the Bureau of Economic Analysis reported. The trade gap shrank more than analysts expected, showing some resiliency amid slower global growth. Auto sales helped increase exports while imports fell from lower cell phone sales.

The moving four-week average for initial unemployment claims rose for the third week in a row but remained near 15-year lows. Employers reluctant to let workers go have kept jobless claims below the 48-year average since early 2013, according to the Labor Department. The trend bodes well for the hiring climate.

The Institute for Supply Management said its non-manufacturing index remained strong despite a slight decline from a 10½-year high in July. The trade association’s index covering industries employing 90% of the U.S. workforce signaled expansion for the 67th month in a row. All 15 industries surveyed reported growth, further suggesting that U.S. economic fortunes can decouple at least to some degree from those in China.

Friday

Employers added fewer jobs than expected in August and at a slower pace, but they added more than previously reported in June and July, and wages ticked up, suggesting a long-awaited rise in pay may be nearing. The Bureau of Labor Statistics reported 173,000 jobs gained in August, 30% below the 12-month average. Some economists suggested end-of-summer statistical flukes could be behind the hiring dip. Manufacturing, mining and other fields more closely tied to overseas economies reduced work forces. Retailers such as restaurants and auto dealers added to their payrolls. Temporary help positions, considered a leading indicator of future hiring, kept climbing. The unemployment rate slipped to 5.1%, the lowest since April 2008. The average hourly wage rose 0.3%, which was better than expected.

Where the Markets Closed for the Week

- Nasdaq – 4,684, down 144 points or 3%

- Standard & Poor’s 500 – 1,921, down 68 points or 3.4%

- 10-year U.S. Treasury Note – 2.13%, down 0.06 point

- Dow Jones Industrial Average – 16,103, down 540 points or 3.2%

Send us a question for our next podcast.

More Insight and Information from Money Talk