Money Talk Podcast, Friday June 30, 2017

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter July edition now available.

Advisors on This Week’s Show

Marc Amateis

Art Rothschild

Chris Evers

(with Max Hoelzl and Joel Dresang)

Week in Review (June 26-30, 2017)

Significant economic indicators & reports

Monday

Durable goods orders declined for the second month in a row in May, falling more than analysts expected and suggesting more struggles for U.S. manufacturers. Excluding the volatile category of transportation equipment, orders gained 0.1%, the fourth increase in five months, but a tell-tale indicator for business investment slipped 0.2% after no change in April. Some economists have warned that lagging business spending has been holding back productivity.

Tuesday

Low supply continued raising home prices in April, according to the S&P CoreLogic Case-Shiller home price index. The 12-month price increase among 20 cities was 5.7%, down from the March pace of 5.9%, but still more than double the general rate of inflation. A housing economist with Standard & Poor’s said higher prices could prompt more homeowners to sell, which would help loosen inventory problems. He said household finances are sturdy enough to sustain the long housing comeback without prompting a housing bubble.

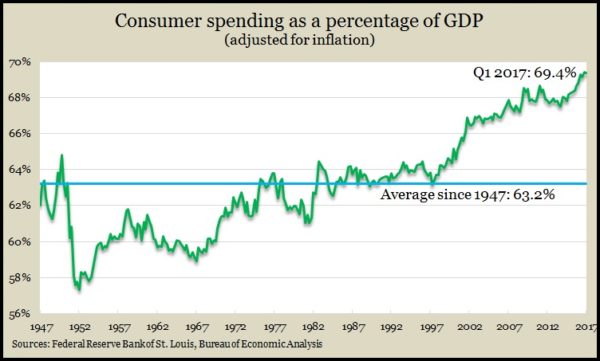

The Conference Board said consumer confidence rebounded in June as enthusiasm toward current economic conditions approached a 16-year high. The business research group said that consumers were less optimistic about future prospects. Based on consumer feedback, the group suggests the U.S. economy will keep growing at a moderate pace but no faster. Economists see consumer confidence as a harbinger of consumer spending, which drives about 70% of economic activity.

Wednesday

In a sign that low inventories may be hampering the housing market, the National Association of Realtors said its pending home sales index sank for the third month in a row in May. The index suffered its second consecutive year-to-year decline. An economist for the trade group cited limited choices and higher prices for dampening demand. Still, the Realtors expect to sell 5.6 million existing houses this year, up 3.2% from 2016.

Thursday

The U.S. economy grew more than previously estimated in the first quarter, up an annual rate of 1.4%, the Bureau of Economic Analysis reported. That surpassed the earlier 1.2% estimate for the quarter but fell short of the 2.1% gain in the fourth quarter. The report showed gross domestic product benefiting from greater consumer spending, which rose at an annual rate of 1.1% – the lowest rate in four years. Consumer spending accounts for nearly 70% of GDP, a rate that has risen gradually over the years. Also, the Federal Reserve Board’s favorite measure of inflation came at the target rate of 2% annual growth.

The moving four-week average for initial unemployment claims fell for the first time in five weeks remaining near the lowest level in 44 years. According to data from the Labor Department, jobless applications have been below the 50-year average every week since early 2013, indicating that employers are cautious about letting workers go. That helps support a stronger job market, which should raise wages and fuel more consumer spending.

Friday

The Bureau of Economic Analysis said personal spending rose just 0.1% in May. Personal income rose o.4%, although wages and salaries advanced just 0.1%. As a result of spending rising slower than income, the personal saving rate increased to 5.5% of disposable income. In the same report, the Federal Reserve’s favorite measure of inflation showed a 1.4% year-to-year increase, marking its third consecutive decline. On a monthly basis, the Fed’s target rate of 2% hasn’t been met since April 2012.

In another indication that greater consumer spending may be on the horizon, the University of Michigan consumer sentiment index fell from its May reading to the lowest point since the November 2016 elections. In the first half of 2017, the gauge of optimism for current conditions and near-future expectations hit its highest average since the second half of 2000. A Michigan economist noted a continued divergence between the relative optimism of Republicans and pessimism of Democrats in the survey. Improvements in personal financial situations are supporting optimism, according to the researcher, who forecasts a 2.3% increase in consumer spending in 2017.

Where the Markets closed for the Week

- Nasdaq – 6,140, down 125 points or 2%

- Standard & Poor’s 500 – 2,423, down 15 points or 0.3%

- 10-year U.S. Treasury Note – 2.3%, up 0.16 point

- Dow Jones Industrial – 21,351, down 45 points or 0.2%

Send us a question for our next podcast.

Follow us on Twitter.

More information and insight from Money Talk

Money Talk Videos

Landaas newsletter subscribers return to the newsletter via e-mail.