Money Talk Podcast, Friday Dec. 18, 2015

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter December edition now available.

Advisors on This Week’s Show

Bob Landaas

Brian Kilb

Marc Amateis

Kyle Tetting

(with Max Hoelzl and Joel Dresang)Week in Review (December 14-18, 2015)

Significant economic indicators & reports

Monday

No major releases

Tuesday

Inflation showed signs of nudging toward the Federal Reserve’s notion of sustainable economic growth in November. The Consumer Price Index, the broadest measure of inflation, rose 2% from the year before but only after excluding food and fuel costs. Including those volatile categories – including gasoline, which has dropped in price by 24% since November 2014 – the CPI gained only 0.5%, according to the Bureau of Labor Statistics. The Fed’s sweet spot is 2%, but its preferred measure, contained in the data on Gross Domestic Product, was up just 1.3% in the latest report.

Wednesday

Extraordinarily warm weather reduced utilities output, pulling down U.S. industrial production in November more than analysts expected. The Federal Reserve said overall output declined for the third consecutive month with continued declines in mining. Manufacturing production was unchanged from October, which experienced a slightly greater setback than initially reported. Capacity utilization shrank for the third month in a row, dipping to the lowest level in 23 months, indicating less inflationary pressure.

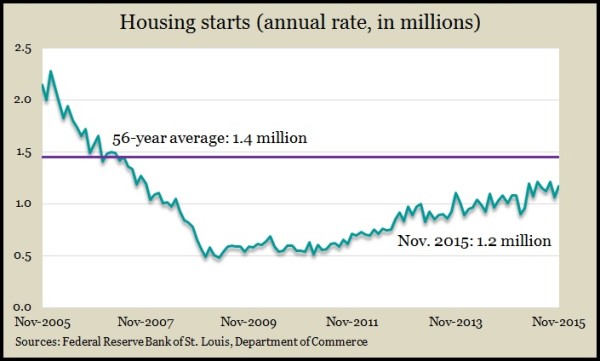

The saw-toothed housing recovery continued in November, with both housing starts and building permits picking up pace more than analysts expected. The Commerce Department said the annual rate of new house construction rose 10.5% from October to nearly 1.2 million structures a year, led by multi-family residences. Although housing starts have returned to their levels before the Great Recession, they’re still below the long-term average. Housing economists at Harvard University have estimated that the U.S. needs a pace of at least 1.6 million housing starts a year to keep up with population growth. Building permits, an indication of future construction, also rose in November, also led by apartments and condominiums.

Thursday

The moving four-week average for initial unemployment claims fell for the second time in three weeks, remaining about 25% below the average level for the last 48 years. Data from the Labor Department suggest employers continue to have little interest in losing the employees they have, which should help lead to the higher wages that fuel consumer confidence and spending.

The U.S. economy should continue moderate growth into 2016, according to the Conference Board’s November index of leading economic indicators. The index rose to its highest point since 2005 and was up for the second month in a row, thanks in part to increased building permits and higher stock prices. The business research group has forecast GDP growth in 2016 to be 2.4%, which is a bit higher than the historical average.

Friday

No major releases

Where the Markets Closed for the Week

- Nasdaq – 4,923, down 10 points or 0.2%

- Standard & Poor’s 500 – 2,006, down 6 points or 0.3%

- 10-year U.S. Treasury Note – 2.2%, up 0.07 point

- Dow Jones Industrial Average – 17,128, down 136 points or 0.8%

Send us a question for our next podcast.

More information and insight from Money Talk